Eval,

Your starting of this thread and tireless contributions are much appreciated.

Can you tell me one missing portion of info regarding your 5minute trading experience... When do you start and end your trading day to achieve these results? This insight would help me in determining how best I might follow and shadow your efforts.

- RD

Your starting of this thread and tireless contributions are much appreciated.

Can you tell me one missing portion of info regarding your 5minute trading experience... When do you start and end your trading day to achieve these results? This insight would help me in determining how best I might follow and shadow your efforts.

- RD

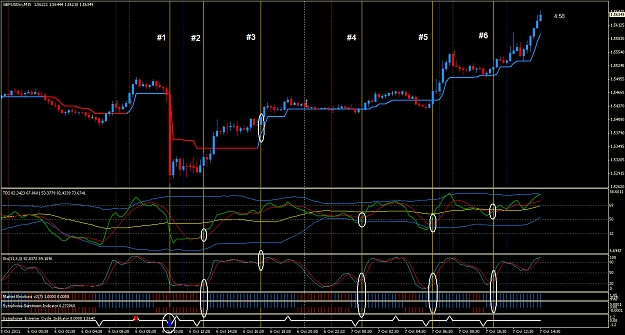

DislikedACCOUNT Statistics Report - WEEK 3

As I have done for the past Friday, I am posting my weekly Account Statistics Report on the Account that I opened when I began this thread.

Three full trading weeks ago, I started this thread and I setup a trading account with 3k the same day (19 September 2011) to strictly trade by the rules defined in this system. This was done in effort to prove this system.

I have tried to be open and honest about all the particulars of this system; posting all orders (good and bad) that I have...Ignored