OK prices have now finally retraced to where you can Sell/buy back into the trend or take the BO into a new direction. I have the IO EA on the following:

USD/CHF

GBP/NZD

GBP/CHF

GPB/AUD

EUR/NZD

EUR/AUD

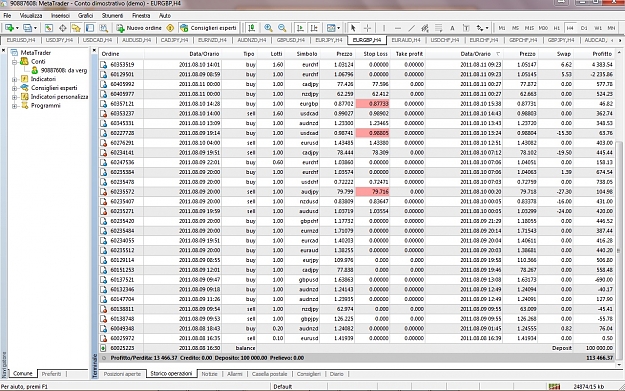

And example picture would look like this:

USD/CHF

GBP/NZD

GBP/CHF

GPB/AUD

EUR/NZD

EUR/AUD

And example picture would look like this: