we'll see.

- Post #13,526

- Quote

- Nov 15, 2011 5:26pm Nov 15, 2011 5:26pm

- | Joined Oct 2011 | Status: Member | 9 Posts

- Post #13,527

- Quote

- Nov 15, 2011 5:28pm Nov 15, 2011 5:28pm

- | Joined Oct 2011 | Status: Member | 9 Posts

- Post #13,528

- Quote

- Nov 15, 2011 6:22pm Nov 15, 2011 6:22pm

Financial independence is what I live for

- Post #13,533

- Quote

- Edited 1:27am Nov 16, 2011 1:15am | Edited 1:27am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets

- Post #13,534

- Quote

- Nov 16, 2011 1:26am Nov 16, 2011 1:26am

- | Joined Oct 2011 | Status: Member | 191 Posts

- Post #13,535

- Quote

- Nov 16, 2011 1:28am Nov 16, 2011 1:28am

- Joined Jul 2011 | Status: Member | 7,748 Posts

If you trade like me, you'll be homeless and broke within a week.

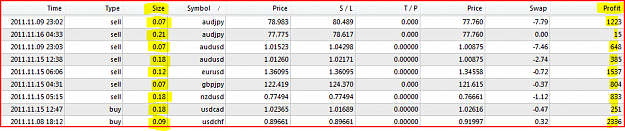

Goldilocks All Time Return:

69.5%

- Post #13,536

- Quote

- Nov 16, 2011 1:56am Nov 16, 2011 1:56am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets

- Post #13,537

- Quote

- Nov 16, 2011 3:01am Nov 16, 2011 3:01am

- | Joined Mar 2007 | Status: Member | 142 Posts

- Post #13,539

- Quote

- Nov 16, 2011 3:16am Nov 16, 2011 3:16am

- Joined Jul 2007 | Status: Member | 80 Posts

- Post #13,540

- Quote

- Nov 16, 2011 3:42am Nov 16, 2011 3:42am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets