“Trading is 10% psychology and 90% mechanics – until you have live money in the market – at which point it becomes 10% mechanics and 90% psychology.” Todd Brown.

"Trading is 90% psychology and 10% system. The way 90% of traders on this thread talk and execute the Big E strategy makes any instruction on managing your emotional state (add: position sizing, profit expectancy and trade management) clearly more important than discussing the angle of the TDI or the value of the Stochastic. The problem is, you have to blow up a few fully loaded accounts to understand this. There has been 10 times the technical discussion than is necessary to implement this system, but people either need their hand held, want to show off or are just too lazy to read the first 50 pages of the thread. The way people on forums (due to the anonymity it affords) can be so rude and condescending guarantees that most good traders (excluding the exceptionally kind hearted, bored or generous ones) don't even bother logging in. It is OK to be new and incompetent or experienced and still incompetent, but you should think twice before posting to prove it. This is not a game - it is just too expensive in time and money to think that way. Sharpen up and start really thinking about the whole process like a business or you will just lose - 100% guaranteed. One thing that I have been told on the subject of psychology that might help someone here is that "emotional traders pay disciplined traders". Repeat it out aloud next time you are in a trade! all the best - H." (Hawaii5000)

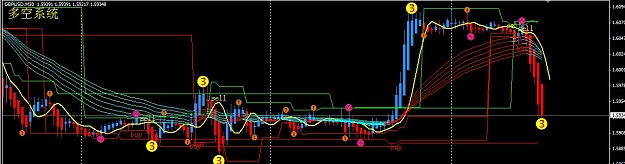

One of the best I have ever seen.

dcginc

"Trading is 90% psychology and 10% system. The way 90% of traders on this thread talk and execute the Big E strategy makes any instruction on managing your emotional state (add: position sizing, profit expectancy and trade management) clearly more important than discussing the angle of the TDI or the value of the Stochastic. The problem is, you have to blow up a few fully loaded accounts to understand this. There has been 10 times the technical discussion than is necessary to implement this system, but people either need their hand held, want to show off or are just too lazy to read the first 50 pages of the thread. The way people on forums (due to the anonymity it affords) can be so rude and condescending guarantees that most good traders (excluding the exceptionally kind hearted, bored or generous ones) don't even bother logging in. It is OK to be new and incompetent or experienced and still incompetent, but you should think twice before posting to prove it. This is not a game - it is just too expensive in time and money to think that way. Sharpen up and start really thinking about the whole process like a business or you will just lose - 100% guaranteed. One thing that I have been told on the subject of psychology that might help someone here is that "emotional traders pay disciplined traders". Repeat it out aloud next time you are in a trade! all the best - H." (Hawaii5000)

One of the best I have ever seen.

dcginc

1