Hi guys,

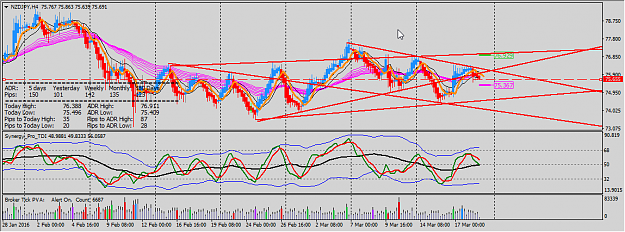

I have been interested in financial markets for 5 years and time to time I tried to invest in forex. All of were failure. I tried also TMS before but it was very little time. I need money that time and I have not courage to stick to this plan. Now, I try to understand and read the posts in this topic. Thanks to great contributors. I will start next week with demo account and try to test my self. Could you please tell your comment for below chart. I guess the short opportunity has come.

I have been interested in financial markets for 5 years and time to time I tried to invest in forex. All of were failure. I tried also TMS before but it was very little time. I need money that time and I have not courage to stick to this plan. Now, I try to understand and read the posts in this topic. Thanks to great contributors. I will start next week with demo account and try to test my self. Could you please tell your comment for below chart. I guess the short opportunity has come.