Disliked{quote} ATR 7 . Read stuff about ADR and 1h so ! thought ATRs inclusion of weekends may give distortion. So I checked for ADR and 1hr TMS trading. Need all the help I can get.Ignored

For H1 intraday trading, you can use the ADR set to 30-days. Even if you have the Sunday candle in your broker, the difference will not impact your trading much. If you feel otherwise, then set the ADR to 60 or 100-days.

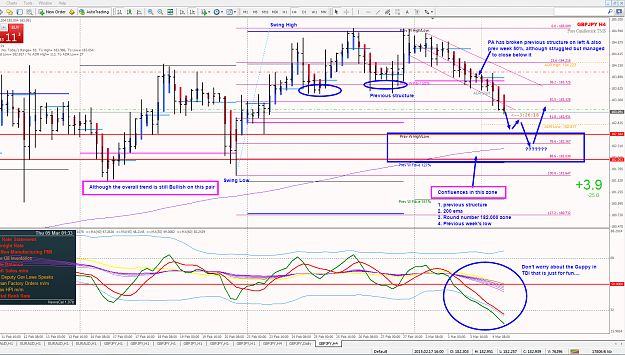

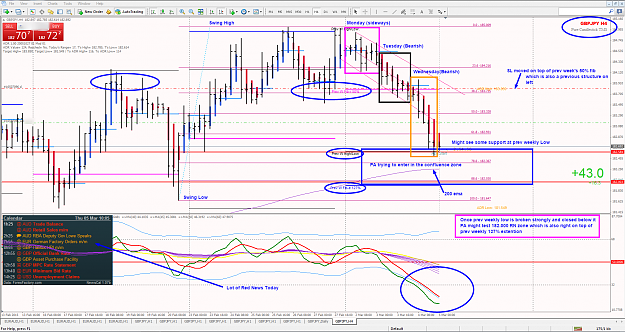

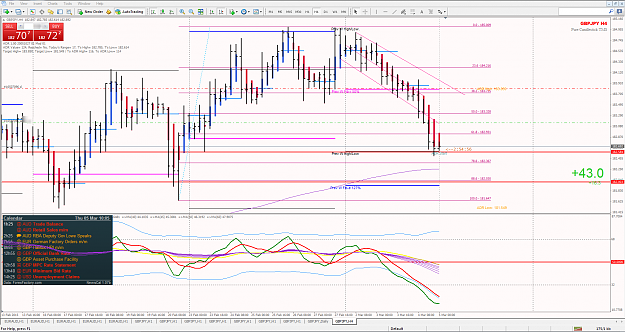

For 4H swing trading, I look at the average weekly trade range for the past 50-weeks and 100-weeks. Take the mean of the two and target only 60% of the weekly range. Do not think of trying to pick tops and bottoms. we need to give room for the reversal to be confirmed then we jump in and then jump out in case the market pulls back. This way, you will survive and fight the following week.

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett