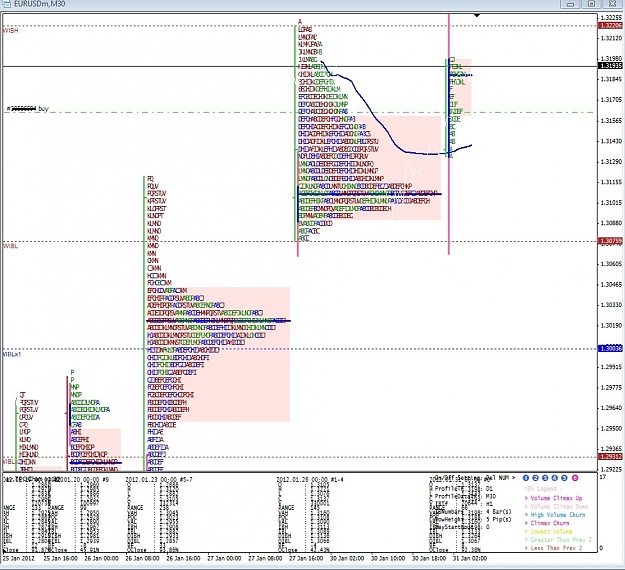

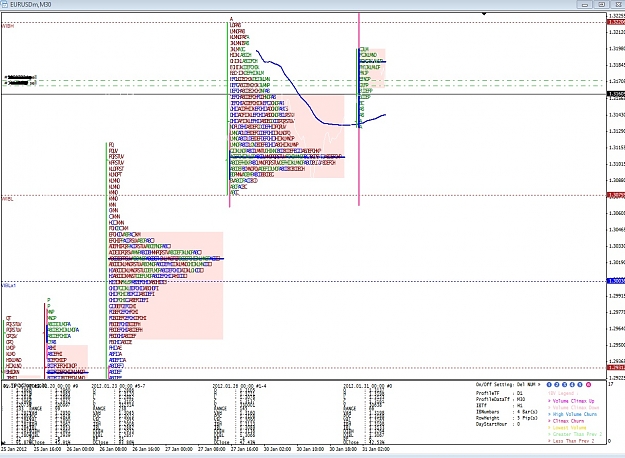

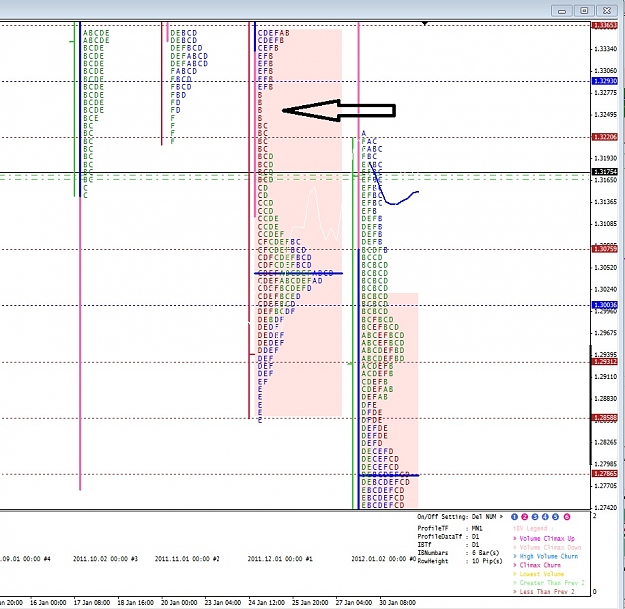

I chose to take a long from a merged profile view. The last 3 days weve had a form of balance. I went long as I saw initiative buying drive outside the previous 3 day balance. From a weekly IB perspective, its some what open drive type of action, and as today will complete te weekly IB, Im thinking price might move to the upside extending the wib, looking for acceptence or rejection at higher prices. Ill look to reverse my position when I get clues of responsive selling.

Markets are not efficient, rather they are effective - Jones