Dislikedonce again you are right. given the support found at current week VAL, would you now expect to explore weekly VAH again?

Ignored

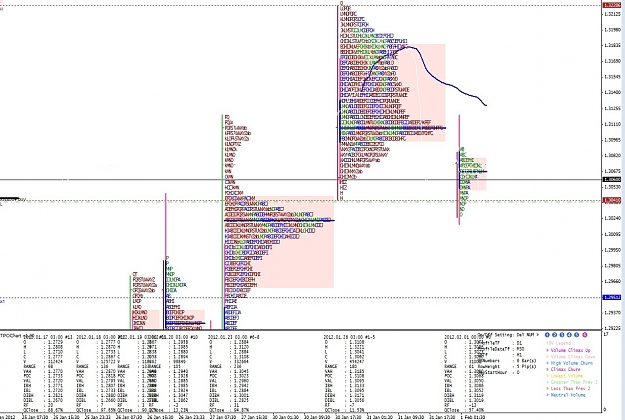

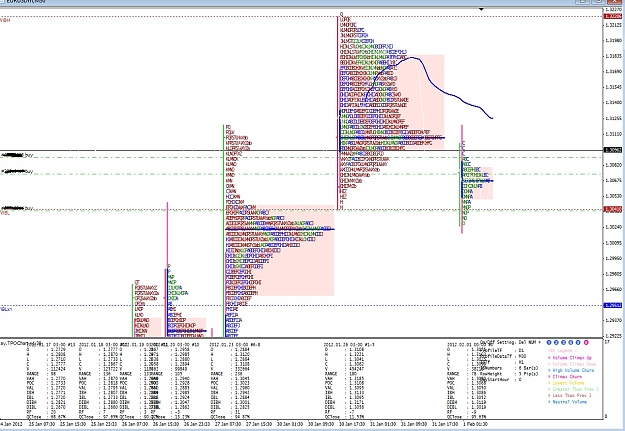

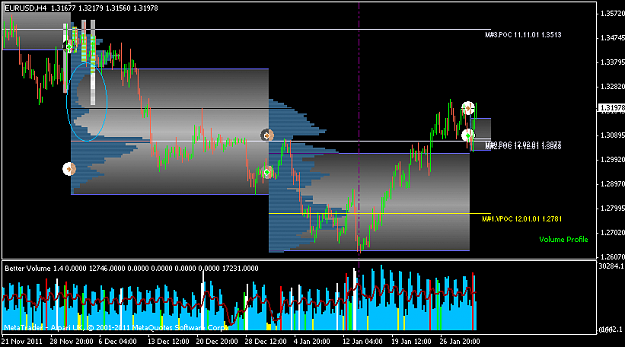

Given yesterdays move, furthur shorts to the down side would be in the books for now towards VAL as price would tend to make another swing low. Since ES is still within the upper range the immediate focus would then be the VAL, expect excess off the VAL too as this would be the normal expection for a reversion. Some lows would have to be clear for stops if price were to have another meaningful reversion , hence last week low point would also be of interest; where excess could be made to hunt stops.

On the flipside, furhur weakness below upper range VAL would be signal by a rejection off it, Price would then proceed to seek support off the lower distribution control.

Note that there are cases were the lower range VAH provide the support, for price to continue to explore furthur into the upper range.

SO; upper dsitribution VAL & the lower distribution VAH would be the immediate focus for any expectation for price to explore up...or down. Another words this area is the LVN..

I think roughly that's my thoughts for now.

EDIT: Just to add that if there is any meaningful rotation within the balance of the "upper range", then it would be natural for the value area to gradually shrink, therefore a good secondary reference would be the current developing week VA.

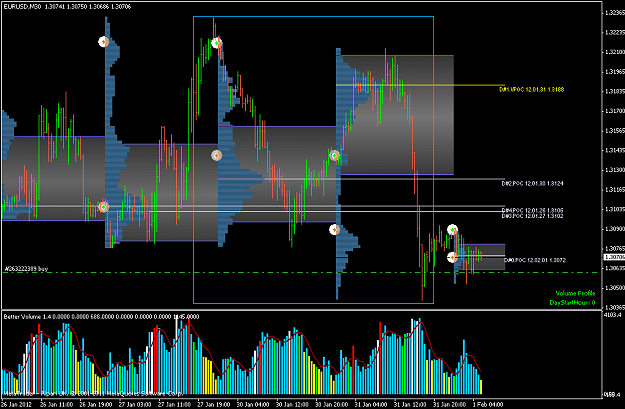

ES chart:

http://img403.imageshack.us/img403/7...6feb011112.gif

Uploaded with ImageShack.us