I wonder, why you think that the chances of winning and lsing are 50:50?

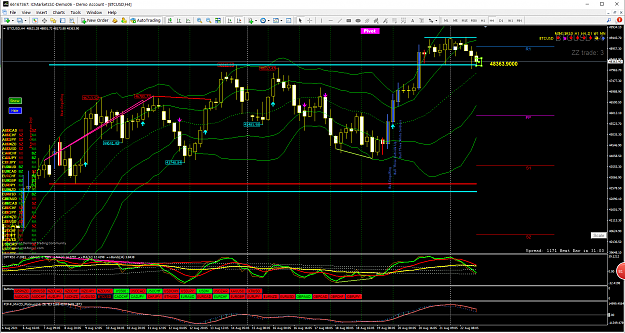

Markets are unpredictable but they are still influenced by many forces which can be tracked down and taken into account while doing market analysis. It is like the weather forecast: imagine that there are heavy clouds and lightening, so, the chances are that it will rain rather it will be sunny in a minute. That is called Bayesian theorem. It includes not only the possibilities of independent events but also the factors that can influence those possibilities. That is why traders do market analysis, because if they could make a living flipping a coin, they wouldn't waste lots of time and efforts on calculations, reading the news and education. They need to determine the forces which affect the price and decide where the price is more likely to go. It is not guessing, but it is about calculating and taking risks.

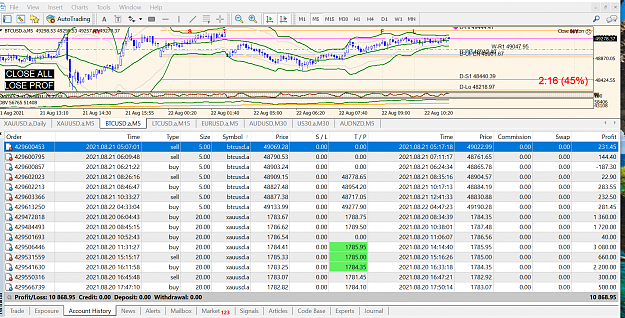

More than that, even if there were 50:50 chance of success, you should also take into account money management. 'If a newbie makes 100 trades'. Do you really think that a beginner can ever make so many trades if they know nothing about money and risk management?

Markets are unpredictable but they are still influenced by many forces which can be tracked down and taken into account while doing market analysis. It is like the weather forecast: imagine that there are heavy clouds and lightening, so, the chances are that it will rain rather it will be sunny in a minute. That is called Bayesian theorem. It includes not only the possibilities of independent events but also the factors that can influence those possibilities. That is why traders do market analysis, because if they could make a living flipping a coin, they wouldn't waste lots of time and efforts on calculations, reading the news and education. They need to determine the forces which affect the price and decide where the price is more likely to go. It is not guessing, but it is about calculating and taking risks.

More than that, even if there were 50:50 chance of success, you should also take into account money management. 'If a newbie makes 100 trades'. Do you really think that a beginner can ever make so many trades if they know nothing about money and risk management?

1