But then agian. Who am I to suggest your Risk.

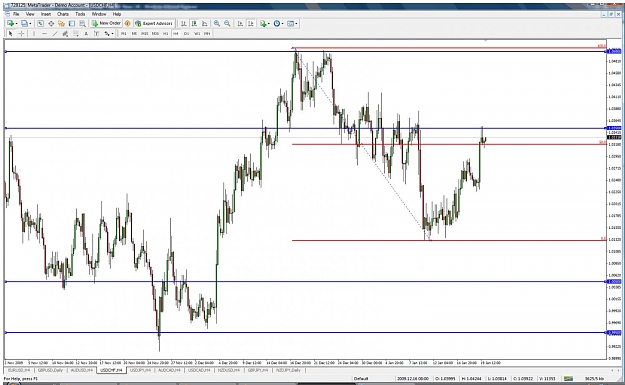

Looks ST Bullish to me...

NOTE*

The Potential Extension of the Channel takes us to the End of the Month. Jan 27th or so

Looks ST Bullish to me...

NOTE*

The Potential Extension of the Channel takes us to the End of the Month. Jan 27th or so