Oil and Russia.....

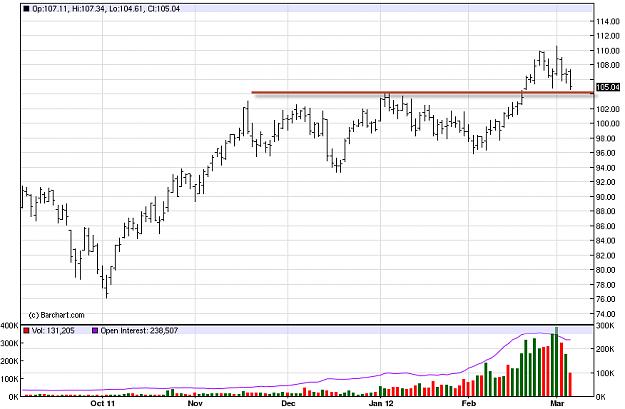

Looking at the white chart, the Light Sweet Crude contract, I see $105 as support. We are approaching that.

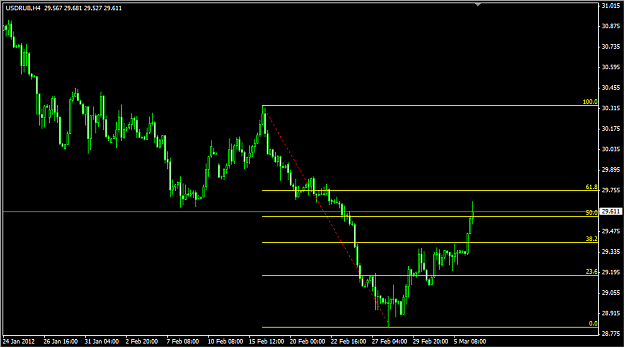

Looking at the black chart, the USD vs. Russian Ruble, we are starting to show resistance at the 50% retrace level on the 4 hour chart.

I smell a possible trade coming........on the close of the candle, I will access the situation and if we get a nice shooting star, I will sell a break lower as it is with the trend too!

Looking at the white chart, the Light Sweet Crude contract, I see $105 as support. We are approaching that.

Looking at the black chart, the USD vs. Russian Ruble, we are starting to show resistance at the 50% retrace level on the 4 hour chart.

I smell a possible trade coming........on the close of the candle, I will access the situation and if we get a nice shooting star, I will sell a break lower as it is with the trend too!