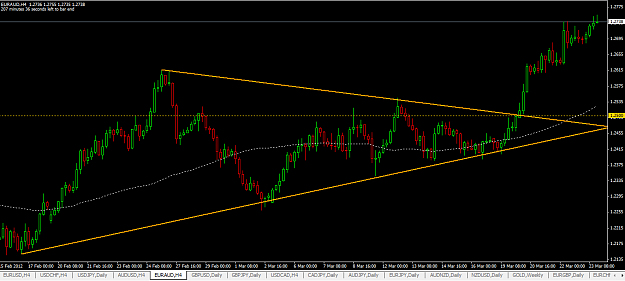

Closed out my EUR/AUD long for a 3.5% bump to the account. Went long at 1.2535 on the triangle breakout.

Probably a premature exit on the trade, but I never really wanted to be long this pair, and prefer banking my success rather than possibly watching wilt away next week.

Will sit on the sidelines on this pair now and wait to see what PA we get if/when it gets closer to 1.30.

Good luck with the AUD Chris

Probably a premature exit on the trade, but I never really wanted to be long this pair, and prefer banking my success rather than possibly watching wilt away next week.

Will sit on the sidelines on this pair now and wait to see what PA we get if/when it gets closer to 1.30.

Good luck with the AUD Chris