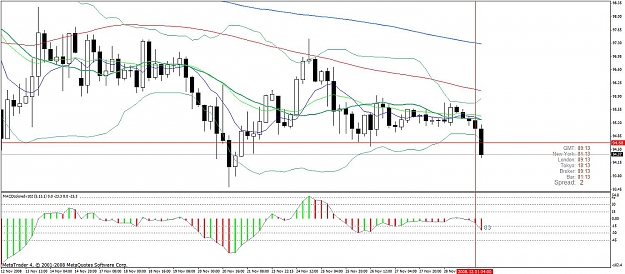

entered on strong market ryhthm,

MACD gave a Zero break signal

breakout pullback formation on the 1H

entry @ 1.2789

S/L @ 1.2830 41pips

TP @ 1.2705 84pips

will close 50% after 25 pips

set remainder at -25 and let rest run

Edit:

Closed 50% @1.2761 28pips

set remainder at -26 pips @ 1.2815

Edit:

Closed another 50% @ 1.2731 58pips

moved S/L to BE +20

Edit:

Closed remaining position manually @ 1.2712 +77pips

few minutes later original TP was hit, but i had to get ready for shopping lol.

MACD gave a Zero break signal

breakout pullback formation on the 1H

entry @ 1.2789

S/L @ 1.2830 41pips

TP @ 1.2705 84pips

will close 50% after 25 pips

set remainder at -25 and let rest run

Edit:

Closed 50% @1.2761 28pips

set remainder at -26 pips @ 1.2815

Edit:

Closed another 50% @ 1.2731 58pips

moved S/L to BE +20

Edit:

Closed remaining position manually @ 1.2712 +77pips

few minutes later original TP was hit, but i had to get ready for shopping lol.

Keeping Life Simple