Hey guy's thanks for keep this thread going,

cogrove, we are all getting wrecked this week mate, but we have had some goooood weeks in the past.

asasa great to hear you have an EA working for this,

ianfOster, it is truely a curse to have to put up with returns like these for such an investment in time and effort!!! i am truely hearing your plea, lol

Ian you are also right in saying that it was too bad for the minority who where hell bent on getting this thread binned, in hind sight i should have been more in control of the direction the thread was heading, but i turely believe in the good in people not the bad.

anyway regardless of them there are plenty of us who continue to follow the simple way that joel had given us, and do our due dilegence every week and place our trades.

cheers

geoff

cogrove, we are all getting wrecked this week mate, but we have had some goooood weeks in the past.

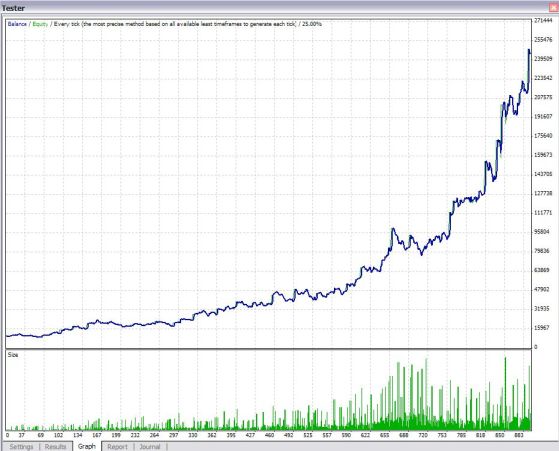

asasa great to hear you have an EA working for this,

ianfOster, it is truely a curse to have to put up with returns like these for such an investment in time and effort!!! i am truely hearing your plea, lol

Ian you are also right in saying that it was too bad for the minority who where hell bent on getting this thread binned, in hind sight i should have been more in control of the direction the thread was heading, but i turely believe in the good in people not the bad.

anyway regardless of them there are plenty of us who continue to follow the simple way that joel had given us, and do our due dilegence every week and place our trades.

cheers

geoff