DislikedThanks for the thread the work and all the knowledge @RiskFighter I am still quite a newbie, I know the basics of course but am not into topics like SMC or wyckoff. That's why I like your strategy with clear rules very much. Do you think it's possible to make 2-3% monthly consistently over years with prop companies? You could later go to higher timeframes like the M30, just to increase the winrate.Ignored

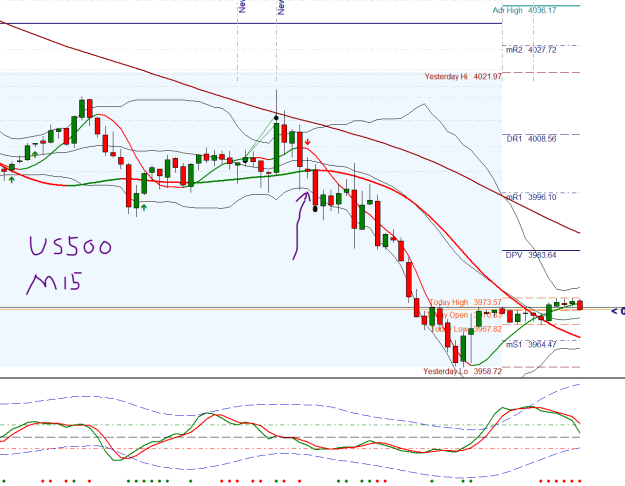

As you can see in post 260, I have made 3%. Used 19 days including weekends and days where I did not trade. But it all depends on your strategy and your diciplin. The robot gives you a lot of possible trades. You must be good at picking the best. And you must have a fine exit strategy. That really is uttermost important.

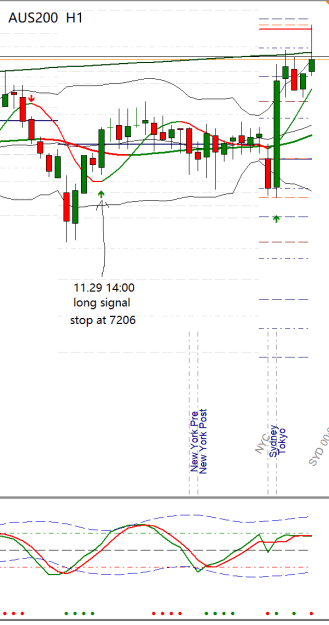

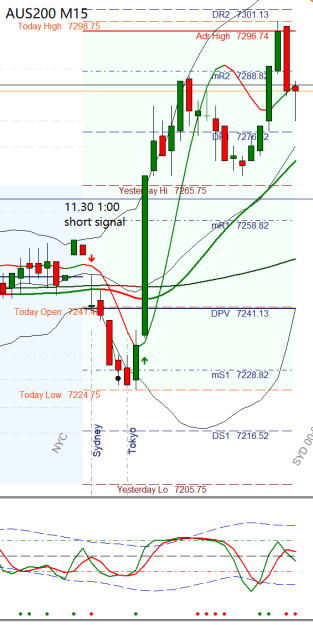

Of cause start on Demo. Take all of the trades. Make a note on each trade how fine a setup you think it is. Check the result and learn. Over time you will have some material that can show you where you are good and where you need to make some improvements. Make you written strategy. Then in a phase 2, take the trades that your strategy tells you. If you are ok, then go live and make money.

Read post #1 !! Then read it again 10 more times before you ask.