First of all, this stategy is quite simple, and but is not a holy grill.

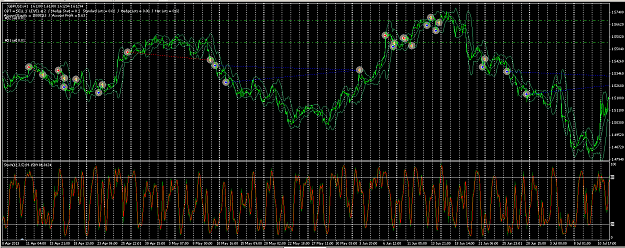

The strategy setup is using the default of Bollinger band (period 20, deviation 2, shift 0 ) and Stochastic ( 14,3,3 ).

Quite long time when i first learn the forex , I hate Stochastic very much, because of my misunderstanding with this indicator.

Later i found it after i am self-experiment ( of course with some my saving money ....

- Filtering my emotion (When i must open or take position )

- Filtering my greedy ( Want to have a big cash in short period )

- Knowing when i can prepare for my next Position ( of course with Bollinger band help and Candlestick reversal pattern )

Ok, This is my simple strategy ( and i am in the progress for my EA with this base of strategy ).

*------- cross with Upper Band ( do the same for lowerband )

Buy Entry

1. The previous candle ( from current candle ) cross BB Upper from below

2. Main Stochastic above Signal Stochastic

3. The Current Candle is bullish and Stochastic below 80

Sell Entry

1. The previous candle ( from current candle ) cross BB upper from above.

2. Main Stochastic below Signal Stochastic

3. The current Candle is bearish and Stochastic above 20

Take profit : 50

Trailing Stop 15

Stop Loss : 50

Time Frame H1

Any Currency.

The candlestick that i often use it Bullish and bearish engulfing.

Please beware that Forex is a business with high risk, This Strategy is work on me, so it's under your own risk.

Trade Well.

no.1 no entry. ( the stochastic is already Overbought area)

no.2 sell entry

no.3 sell entry