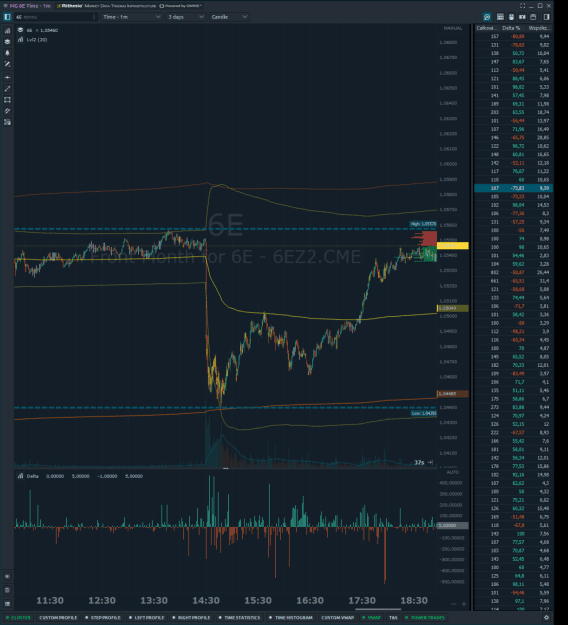

It seems obvious etc however - when combine it with also obvious @ryuryu observation regarding the walls - it become more profound. Market orders entering opposite to the wall, could be a kind of trigger.

Pls remember i only have 12 hours of DOM, but what i saw - can not be unseen

2