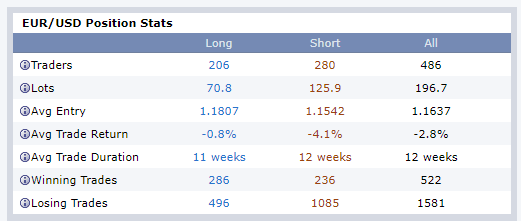

Disliked{quote} i seem to remember that last week as we were approaching 1.2000 you were firmly LONG and headed for 1.2500, and you stated clearly that you are a long term trader that trades like the big boys and you also insisted that trading is not gambling. but then when the eurusd dropped a hundred points, you stated that you had closed that long position. {quote} you took a loss, and yet you insist that trading is not gambling. i am an amateur, but i enjoy asking questions and i enjoy details. please dont ban me again and ease up on the $%^&* insults...Ignored

In your post, you ask not to be banned, so I assume you already know your antagonistic approach to conversation will cause an emotional response from traders who share quality information. I believe it would be more beneficial for you to post your charts for everyone to evaluate how and if they benefit others in the thread. Currently I am in a very mellow mood, and prefer to stay that way. I am not sure why there is a need to cause drama. You may have some fantastic information to share that we can all benefit from. However your current approach reminds me of people who decide to join a gym when they are not up to the level of the top people that have been working out for years. When people tend to first start out lifting, myself included many years ago, it is easy to feel uncomfortable. Luckily the individuals who had been there for a while were happy to share how they increased in size using techniques others shared with them. Then I as well as others before and after me were able to use the information to grow stronger. Now I wonder what would happen if I started to call one of these people out who had been training for years? Would I expect kindness after my comments or something more abrupt? Hmmmm that answer would be obvious.

Make no mistake, I do not need to defend any of these high performers, just want to provide a different thought process. Just remember, continuing on the path of someone being antagonistic, do not be surprised with the result you receive. As I mentioned, I have been enjoying my beer and am bbq'ing this weekend, as it is a Texas thing. I wish everyone a calm and peaceful weekend. There is no need to piss people off on a Saturday. Gotta go, I need a refill, my bottle seemed to have leaked out again. They get empty so fast. LOL Gotta go, there is something ice cold waiting for me and it is not my wife running over my bbq pit again.

"What the wise do in the beginning, fools do in the end."-Warren Buffet

4