Disliked{quote} Yes I think you can modify anything. Give it a go that's fine.Ignored

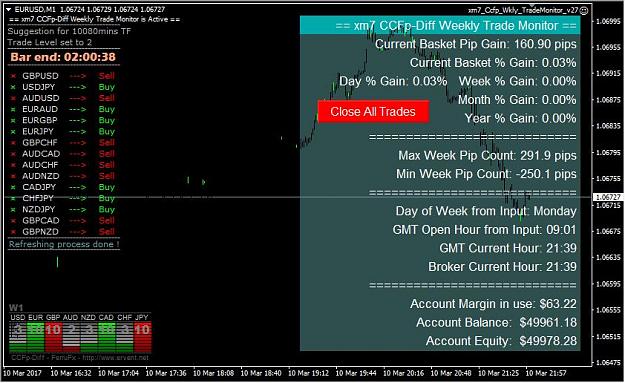

Instead, I'm trying to put together other pair selection methods that can be tested for effectiveness; sort of like a human indicator until the rules are well-defined enough for it to be constructed into an indicator.

I think others might also be interested in finding other pair selection methods. Once it becomes more defined and systematic, they can then forward test and compare their results to estimate what works best to provide the pairs to trade for the basket. But this would put focus on testing different pair selection methods for comparison and I don't know how to organize that editable spreadsheet's PSM tab to make that sort of thing easy for comparison.