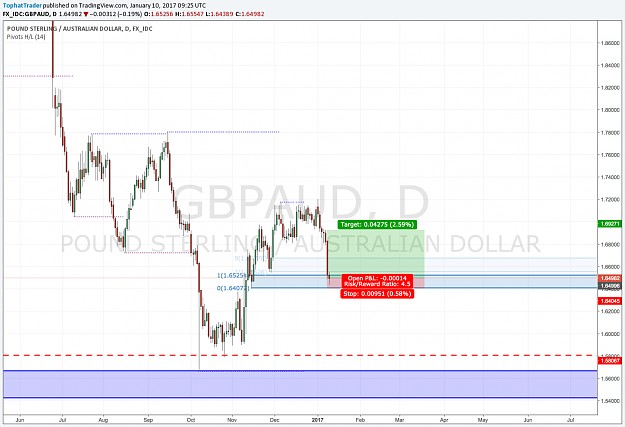

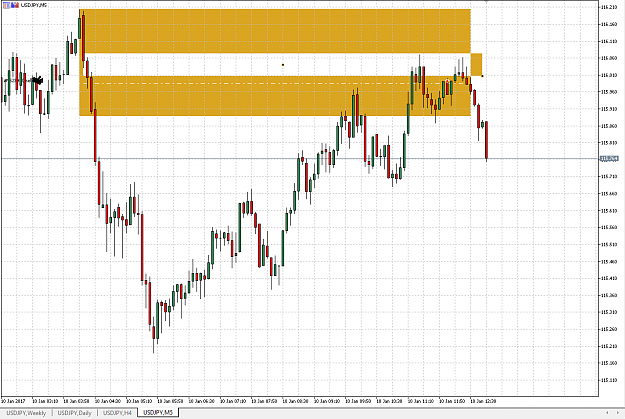

Disliked{quote} Hello Chino Welcome to T.I.O.F Correct, it is a demand zone It is important for those taking day trades that given where price is, taking shorts is lower probability best wishesIgnored

Should we go long since it is in the Demand Zone?