Please design an EA for me with the following conditions as described in the video. I have also attached a PDF versions of the conditions on which a trade is executed. I have also written the conditions below. Thank you so much in advance to anyone willing to help.

Conditions:

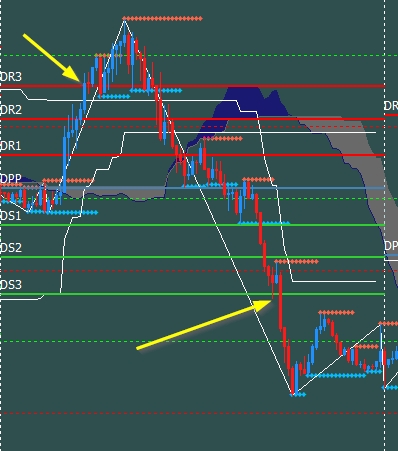

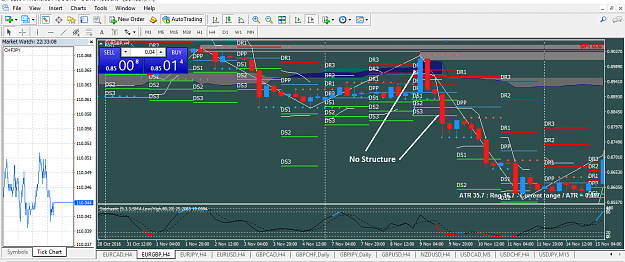

Pivot Structure ADR Rules Take The Best Trades Available Broker must be GMT + 2 It is best to take trades from 8PM EST(3AM GMT+2) to 11AM EST(18:00 GMT + 2) Its best not to take trades after 12PM EST(19:00 GMT+2) because the volume drops and price consolidates until the next day. Works best in Late Asian-London overlap and London-US overlap. Taking trades at or after 19:00 GMT+2 time is ok but only do it if you dont get an earlier opportunity or if you're on a roll Long Trade Conditions- Entry is 3 pips below the level

1. Price goes below ADR Low and goes below DS3 pivot when DS3 is below ADR low

2. Price goes below ADR Low and goes below DS3 pivot when DS3 is below ADR low and inside an H4 Demand Zone

3. Price goes below ADR Low and goes below DS3 pivot when ADR low is below DS3

4. Price goes below ADR Low and goes below DS3 pivot when ADR low is below DS3 inside an H4

Demand Zone

5. Price goes below ADR Low and goes below DS2 pivot when DS2 is below ADR low inside an H4 Demand Zone

6. Price goes below ADR Low and goes below DS1 pivot when DS1 is below ADR low inside an H4 Demand Zone

Stoploss options:

A. 3 times the ATR in pips + spread on the M15 chart(if there is no H4 Demand zone)

B. 15 pips Below the H4 Demand Zone(if there is an H4 demand zone)

C. 3 times the ATR in pips + spread on the M15 chart( If after 3ATR + spread, stoploss is still inside H4 demand zone, set the stop loss right below the demand zone).

Short Trade Conditions

1. Price goes above ADR High and goes above DR3 pivot when DR3 is above ADR High

2. Price goes above ADR High and goes above DR3 pivot when DR3 is above ADR High inside an H4 Supply Zone

3. Price goes above ADR High and goes above DR3 pivot when ADR High is above DR3

4. Price goes above ADR High and goes above DR3 pivot when ADR High is above DR3 inside an H4 Supply Zone

5. Price goes above ADR High and goes above DR2 pivot when DR2 is above ADR High inside an H4 Supply Zone

6. Price goes above ADR High and goes above DR1 pivot when DR1 is above ADR High inside an H4 Supply Zone

Stoploss options:

A. 3 times the ATR in pips + spread on the M15 chart(if there is no H4 Supply zone)

B. 15 pips Below the H4 Supply) Zone(if there is an H4 supply zone)

C. 3 times the ATR in pips + spread on the M15 chart( If after 3ATR + spread, stoploss is still inside H4 supply zone, set the stop loss right below the supply zone).

Reward to Risk Options:

1. 1:1

2. .6:1

3. 2:1

Custom Lot Size calculator with Risk entry field.

Indicators and Templates:

https://www.dropbox.com/sh/w4ctsxkng...G1yHoMwka?dl=0

PDF version of conditions:

Inserted Video

Conditions:

Pivot Structure ADR Rules Take The Best Trades Available Broker must be GMT + 2 It is best to take trades from 8PM EST(3AM GMT+2) to 11AM EST(18:00 GMT + 2) Its best not to take trades after 12PM EST(19:00 GMT+2) because the volume drops and price consolidates until the next day. Works best in Late Asian-London overlap and London-US overlap. Taking trades at or after 19:00 GMT+2 time is ok but only do it if you dont get an earlier opportunity or if you're on a roll Long Trade Conditions- Entry is 3 pips below the level

1. Price goes below ADR Low and goes below DS3 pivot when DS3 is below ADR low

2. Price goes below ADR Low and goes below DS3 pivot when DS3 is below ADR low and inside an H4 Demand Zone

3. Price goes below ADR Low and goes below DS3 pivot when ADR low is below DS3

4. Price goes below ADR Low and goes below DS3 pivot when ADR low is below DS3 inside an H4

Demand Zone

5. Price goes below ADR Low and goes below DS2 pivot when DS2 is below ADR low inside an H4 Demand Zone

6. Price goes below ADR Low and goes below DS1 pivot when DS1 is below ADR low inside an H4 Demand Zone

Stoploss options:

A. 3 times the ATR in pips + spread on the M15 chart(if there is no H4 Demand zone)

B. 15 pips Below the H4 Demand Zone(if there is an H4 demand zone)

C. 3 times the ATR in pips + spread on the M15 chart( If after 3ATR + spread, stoploss is still inside H4 demand zone, set the stop loss right below the demand zone).

Short Trade Conditions

1. Price goes above ADR High and goes above DR3 pivot when DR3 is above ADR High

2. Price goes above ADR High and goes above DR3 pivot when DR3 is above ADR High inside an H4 Supply Zone

3. Price goes above ADR High and goes above DR3 pivot when ADR High is above DR3

4. Price goes above ADR High and goes above DR3 pivot when ADR High is above DR3 inside an H4 Supply Zone

5. Price goes above ADR High and goes above DR2 pivot when DR2 is above ADR High inside an H4 Supply Zone

6. Price goes above ADR High and goes above DR1 pivot when DR1 is above ADR High inside an H4 Supply Zone

Stoploss options:

A. 3 times the ATR in pips + spread on the M15 chart(if there is no H4 Supply zone)

B. 15 pips Below the H4 Supply) Zone(if there is an H4 supply zone)

C. 3 times the ATR in pips + spread on the M15 chart( If after 3ATR + spread, stoploss is still inside H4 supply zone, set the stop loss right below the supply zone).

Reward to Risk Options:

1. 1:1

2. .6:1

3. 2:1

Custom Lot Size calculator with Risk entry field.

Indicators and Templates:

https://www.dropbox.com/sh/w4ctsxkng...G1yHoMwka?dl=0

PDF version of conditions:

Attached File(s)