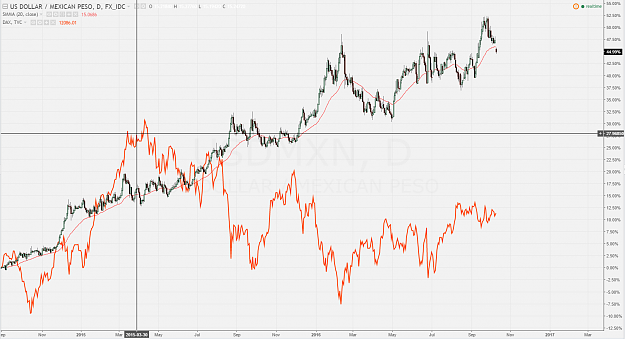

Disliked{quote} It is a nice carry too. For now all HRC has to sit tight and she will be in the seat. Trump manage to do the self destruction. Has been drawing a longer term map with major S/R areas and possible flip how I look it. Nice Trumpometer. It is a trade that will need a lot of patience. I have outlook short term strong sell, mid term sell, and long term neutral. PS correlation to oil is almost non existing I attach also correlation table. {image} {image}Ignored

- Post #144,021

- Quote

- Oct 10, 2016 6:44am Oct 10, 2016 6:44am

- | Joined Jun 2016 | Status: Member | 255 Posts

- Post #144,022

- Quote

- Oct 10, 2016 6:46am Oct 10, 2016 6:46am

- Joined Sep 2013 | Status: OTM AI IntelliWave™ Trader | 1,107 Posts

Trading in the shadow of SM

- Post #144,024

- Quote

- Oct 10, 2016 6:59am Oct 10, 2016 6:59am

"Bulls make money, bears make money, pigs get slaughtered"

- Post #144,025

- Quote

- Oct 10, 2016 7:01am Oct 10, 2016 7:01am

"Bulls make money, bears make money, pigs get slaughtered"

- Post #144,026

- Quote

- Oct 10, 2016 7:03am Oct 10, 2016 7:03am

"Bulls make money, bears make money, pigs get slaughtered"

- Post #144,027

- Quote

- Edited 9:45am Oct 10, 2016 9:14am | Edited 9:45am

- Joined Sep 2013 | Status: OTM AI IntelliWave™ Trader | 1,107 Posts

Trading in the shadow of SM

- Post #144,028

- Quote

- Oct 10, 2016 9:46am Oct 10, 2016 9:46am

"Bulls make money, bears make money, pigs get slaughtered"

- Post #144,029

- Quote

- Oct 10, 2016 9:47am Oct 10, 2016 9:47am

- Joined Feb 2006 | Status: Member | 1,718 Posts

- Post #144,030

- Quote

- Oct 10, 2016 10:04am Oct 10, 2016 10:04am

- Joined Aug 2009 | Status: Ride the Pig | 31,178 Posts

Look Sharp/Trade Tight

- Post #144,031

- Quote

- Oct 10, 2016 10:22am Oct 10, 2016 10:22am

- Joined Apr 2013 | Status: I'm learnding! | 8,973 Posts

- Post #144,032

- Quote

- Oct 10, 2016 10:43am Oct 10, 2016 10:43am

- Joined Aug 2009 | Status: Ride the Pig | 31,178 Posts

Look Sharp/Trade Tight

- Post #144,033

- Quote

- Oct 10, 2016 11:45am Oct 10, 2016 11:45am

"Bulls make money, bears make money, pigs get slaughtered"

- Post #144,034

- Quote

- Oct 10, 2016 12:02pm Oct 10, 2016 12:02pm

- Joined Sep 2013 | Status: OTM AI IntelliWave™ Trader | 1,107 Posts

Trading in the shadow of SM

- Post #144,035

- Quote

- Oct 10, 2016 12:07pm Oct 10, 2016 12:07pm

- Joined Apr 2013 | Status: I'm learnding! | 8,973 Posts

- Post #144,036

- Quote

- Oct 10, 2016 12:13pm Oct 10, 2016 12:13pm

"Bulls make money, bears make money, pigs get slaughtered"

- Post #144,037

- Quote

- Oct 10, 2016 1:46pm Oct 10, 2016 1:46pm

- | Joined Aug 2013 | Status: "Don't follow me i'm already lost " | 1,136 Posts

Re-Incarnated

- Post #144,038

- Quote

- Oct 10, 2016 1:51pm Oct 10, 2016 1:51pm

- | Joined Mar 2015 | Status: Member | 247 Posts

Im a Crocodile, Im a Sniper. Patience is everything.

- Post #144,039

- Quote

- Oct 10, 2016 1:54pm Oct 10, 2016 1:54pm

- | Joined Aug 2013 | Status: "Don't follow me i'm already lost " | 1,136 Posts

Re-Incarnated

- Post #144,040

- Quote

- Oct 10, 2016 2:03pm Oct 10, 2016 2:03pm

- | Joined Jul 2013 | Status: Member | 1,873 Posts

Get Rich or Die Tryin