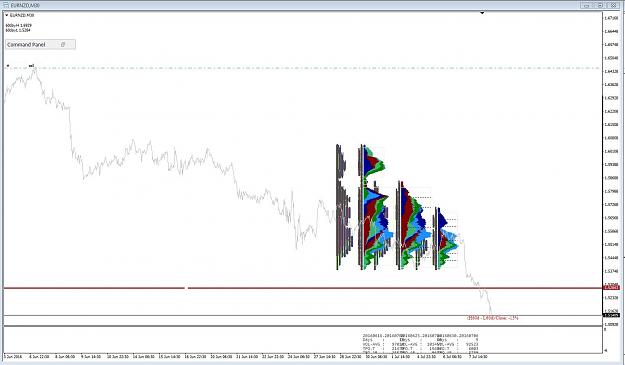

I have a question about standard deviation, I got the values 2.15, 13.6, 34.1 supposedly for the first second and third standard deviation?

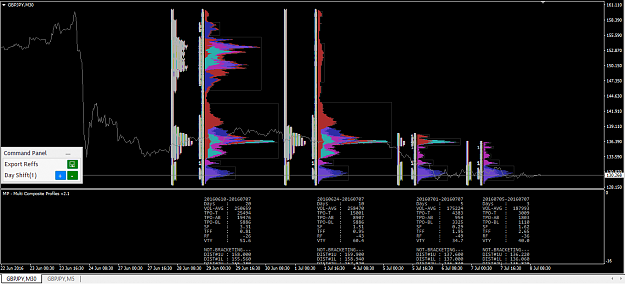

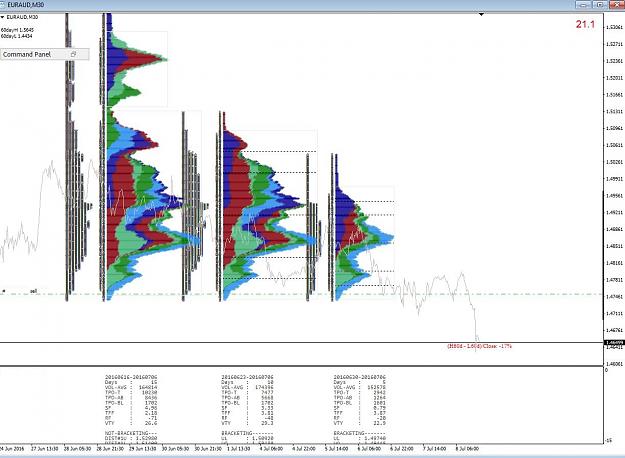

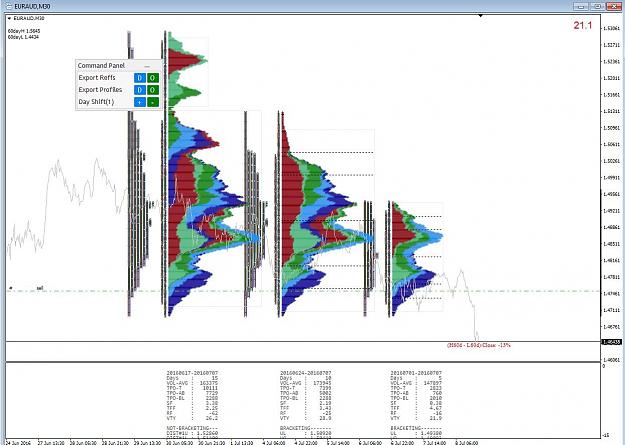

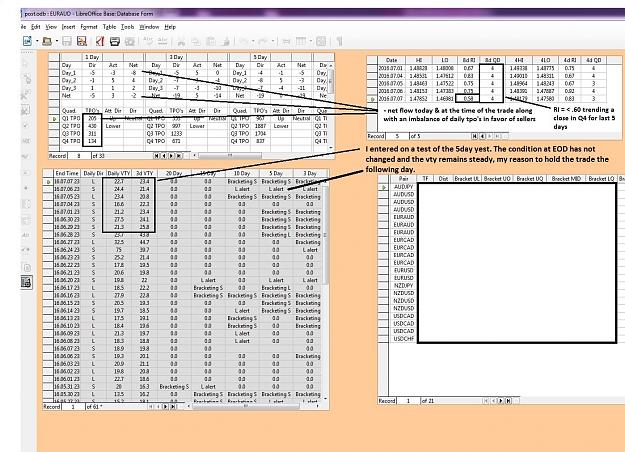

I'm trying to figure out how to calculate them based of the market profile. I'm not sure but I suppose it would be a deviation from the POC?

btw, is the VAH and VAL second or is it first standard deviation? this is a bit interesting because apparently,

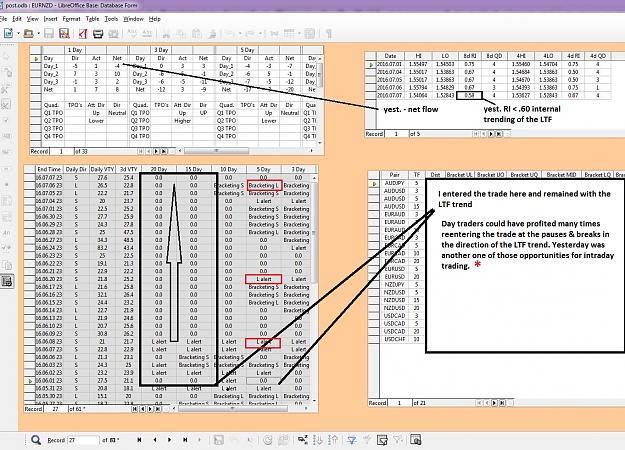

if we get through a 3:rd deviation there is a 35% chance to get to the 4:th, meaning also a 65% chance of a reversal.

if we get through the 4:th deviation, there is a 80% chance to get to the 5:th deviation

if we get though the 5:th deviation, there is a 100% to get all the way up to the 9:th deviation.

good stuff, the question is, how to implement it together with the Value area and market auction theory?

I'm thinking about creating deviation lines on top of the MP. ideas please.

I'm trying to figure out how to calculate them based of the market profile. I'm not sure but I suppose it would be a deviation from the POC?

btw, is the VAH and VAL second or is it first standard deviation? this is a bit interesting because apparently,

if we get through a 3:rd deviation there is a 35% chance to get to the 4:th, meaning also a 65% chance of a reversal.

if we get through the 4:th deviation, there is a 80% chance to get to the 5:th deviation

if we get though the 5:th deviation, there is a 100% to get all the way up to the 9:th deviation.

good stuff, the question is, how to implement it together with the Value area and market auction theory?

I'm thinking about creating deviation lines on top of the MP. ideas please.

Bulls are stupid Animals!especially when Im short!