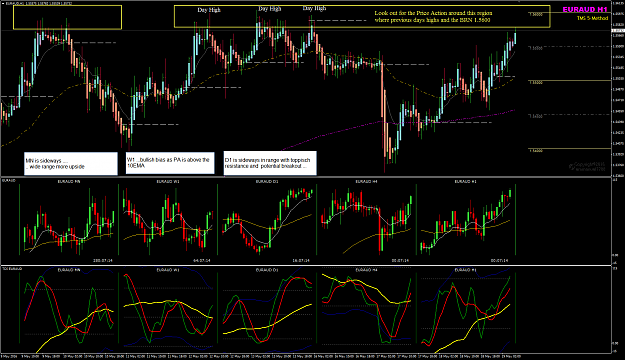

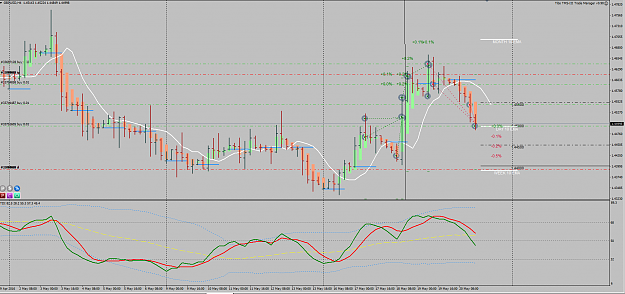

EURAUD Big Picture Plan update Week 20 May 19.

Just had a quick review with a few full time traders here and thought I share my BPP for EA to trade in the coming days ahead.

May not happen this week, but the current PA is very close to the BRN which was tested by several days Highs.

The market does not promise anything to anyone. As traders we need to be diligent in our work and be consistent in everything that we do.

Remember DISCIPLINE is one of the many keys to unlock your potential and create your own winning edge in this trading as a business.

I am looking to buy above 1.5600 with target 1.5900. We shall see what the amrket will do in the following days.

Trade Well and always trade with stop loss to preserve your trading capital.

Just had a quick review with a few full time traders here and thought I share my BPP for EA to trade in the coming days ahead.

May not happen this week, but the current PA is very close to the BRN which was tested by several days Highs.

The market does not promise anything to anyone. As traders we need to be diligent in our work and be consistent in everything that we do.

Remember DISCIPLINE is one of the many keys to unlock your potential and create your own winning edge in this trading as a business.

I am looking to buy above 1.5600 with target 1.5900. We shall see what the amrket will do in the following days.

Trade Well and always trade with stop loss to preserve your trading capital.

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett