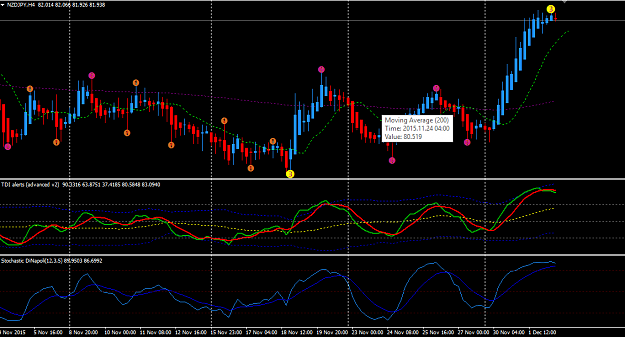

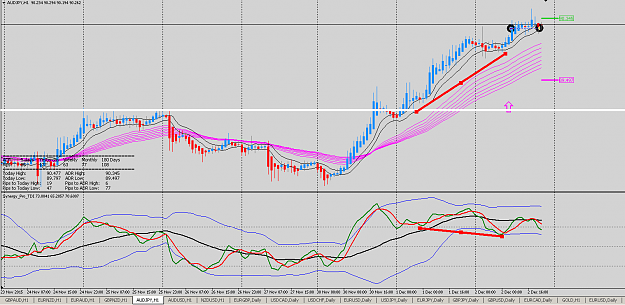

Is it time to go short? Look at this upper move, price hat to ratrace soon...

- Post #63,905

- Quote

- Dec 2, 2015 7:50am Dec 2, 2015 7:50am

Never argue with a fool; onlookers may not be able to tell the difference.

- Post #63,908

- Quote

- Dec 2, 2015 8:20am Dec 2, 2015 8:20am

Never argue with a fool; onlookers may not be able to tell the difference.

- Post #63,910

- Quote

- Dec 2, 2015 10:34am Dec 2, 2015 10:34am

- | Joined Nov 2015 | Status: Member | 37 Posts

Trading is simply about managing the area between your ears

- Post #63,911

- Quote

- Dec 2, 2015 10:48am Dec 2, 2015 10:48am

why do we fall? So we can learn to pick ourselves up.

- Post #63,913

- Quote

- Dec 2, 2015 11:31am Dec 2, 2015 11:31am

- | Joined Nov 2015 | Status: Member | 37 Posts

Trading is simply about managing the area between your ears

- Post #63,916

- Quote

- Dec 2, 2015 12:29pm Dec 2, 2015 12:29pm

- | Joined Nov 2015 | Status: Junior Member | 2 Posts

- Post #63,917

- Quote

- Dec 2, 2015 12:44pm Dec 2, 2015 12:44pm

- Joined Jul 2013 | Status: Member | 1,045 Posts

- Post #63,918

- Quote

- Dec 2, 2015 12:44pm Dec 2, 2015 12:44pm

- Joined Jul 2013 | Status: Member | 1,045 Posts

- Post #63,919

- Quote

- Dec 2, 2015 1:02pm Dec 2, 2015 1:02pm

- Joined Jul 2013 | Status: Member | 1,045 Posts

- Post #63,920

- Quote

- Dec 2, 2015 2:22pm Dec 2, 2015 2:22pm

- Joined Jul 2013 | Status: Member | 1,045 Posts