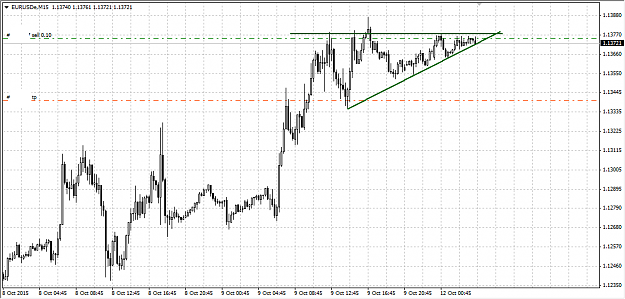

DislikedI am new trader. I am facing a confusion. Can anyone give me suggestion about this. I am loosing trade almost lot of money. My account cannot survive more than 1.1390. If it cross balance will be zero or I need to deposit more.Ignored

Close the trade and withdraw the money, because you are doing the basic mistakes.

You have over leveraged

You aren't going out when you loose

You ask others , because you don't have any trade strategy: what if somebody say stay and others say out?! It is your money man.

Go to Demo account and trade until you have 3 month consecutive win

Come back after that to Live

For sure not deposit more...

You have to learn, you will blow many account anyhow, but what makes you ever think if you can't make money in a Demo account you will in Live one???

I want to buy PATIENCE