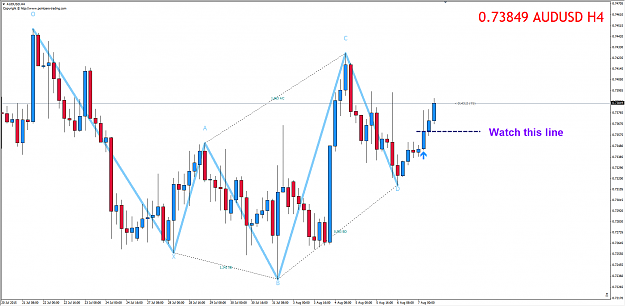

DislikedLong entry at .7350. TP at .7400. Tight SL below .7350. Let's see how this PA plays out. Green Pips day to all!Ignored

- Post #91,483

- Quote

- Aug 5, 2015 3:07am Aug 5, 2015 3:07am

- | Joined Dec 2014 | Status: Member | 6 Posts

- Post #91,489

- Quote

- Aug 5, 2015 7:04pm Aug 5, 2015 7:04pm

"Luxury is one of the basic needs", (c), Don Corleone

- Post #91,492

- Quote

- Aug 5, 2015 10:37pm Aug 5, 2015 10:37pm

Hope for the best, prepare for the worst.

- Post #91,493

- Quote

- Aug 5, 2015 10:43pm Aug 5, 2015 10:43pm

- Joined Oct 2011 | Status: quo | 4,193 Posts

As Above, So Below

- Post #91,494

- Quote

- Aug 5, 2015 11:22pm Aug 5, 2015 11:22pm

- | Joined Nov 2011 | Status: Member | 254 Posts

- Post #91,496

- Quote

- Aug 6, 2015 3:29am Aug 6, 2015 3:29am

"Luxury is one of the basic needs", (c), Don Corleone

- Post #91,498

- Quote

- Aug 7, 2015 8:20am Aug 7, 2015 8:20am

- Joined Jul 2011 | Status: Member | 7,749 Posts | Online Now

If you trade like me, you'll be homeless and broke within a week.

Goldilocks All Time Return:

44.1%