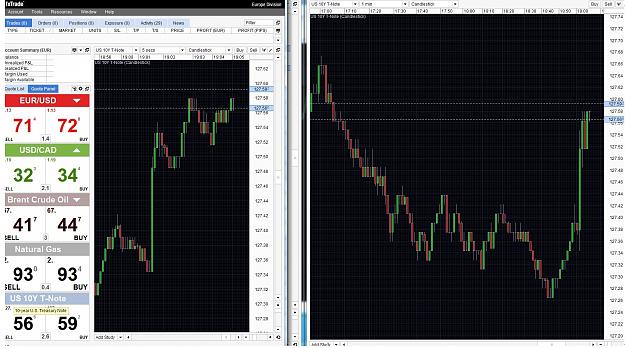

I don't want to spam here but the treasury auctions are on my watch list as well now. The spread did not change at all and if this event proves to generate such a huge move it might be worth trading.

- Post #14,424

- Quote

- May 14, 2015 5:19am May 14, 2015 5:19am

There are many wise people, but only a few of them are rich.

- Post #14,426

- Quote

- May 15, 2015 10:54pm May 15, 2015 10:54pm

- Joined Apr 2008 | Status: sometimes... news come unexpected | 7,432 Posts

Invest in alarm clocks

- Post #14,432

- Quote

- May 19, 2015 3:36pm May 19, 2015 3:36pm

- Joined Nov 2013 | Status: Trading Chaos | 1,133 Posts

- Post #14,435

- Quote

- May 31, 2015 4:17am May 31, 2015 4:17am

- Joined Nov 2013 | Status: Trading Chaos | 1,133 Posts

- Post #14,437

- Quote

- Jun 2, 2015 3:20pm Jun 2, 2015 3:20pm

- | Joined Feb 2014 | Status: Member | 198 Posts

- Post #14,438

- Quote

- Jun 3, 2015 8:44am Jun 3, 2015 8:44am

- Joined Nov 2013 | Status: Trading Chaos | 1,133 Posts

- Post #14,439

- Quote

- Jun 3, 2015 8:57am Jun 3, 2015 8:57am

- Joined Nov 2013 | Status: Trading Chaos | 1,133 Posts