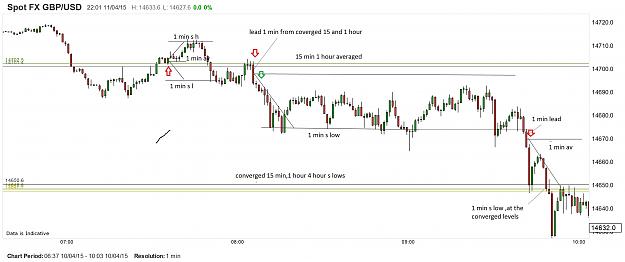

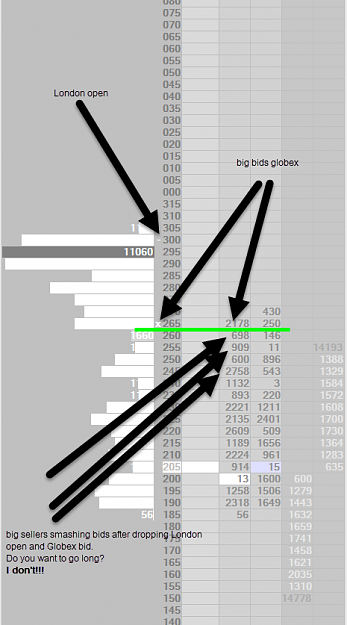

Disliked{quote} Thanks Neio for this thread. This below (pics) is my contribution to statistical analysis. In one point I disagree with you: it's not 95% of times price moves away from the open. It's less. I considered O-C <= 0.5 pips and more or less only 85% of times price moves above or below the open.(at least for this pair). Anyway thanks {image}

Ignored