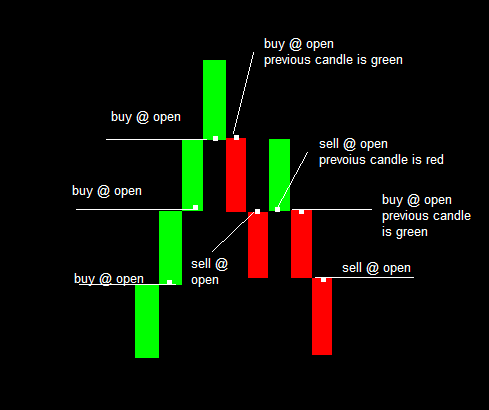

DislikedHello, new in the thread. About the "chop-chop market monster" encountered here {quote} For one possible solution can turn to the discussed method ITSELF - the Renko bars. Consider the method that Renko bricks are calculated from the raw input of PA. It is a FILTER. A Filter receives the price movements as its Input and calculates the Renko signal as its Output i.e. 'New Brick Formed' = True i.e. Price Change is Significant enough or 'New Brick Formed' = False i.e. Price Change is NOT Significant Enough By insignificant what is meant - oscillating,...Ignored

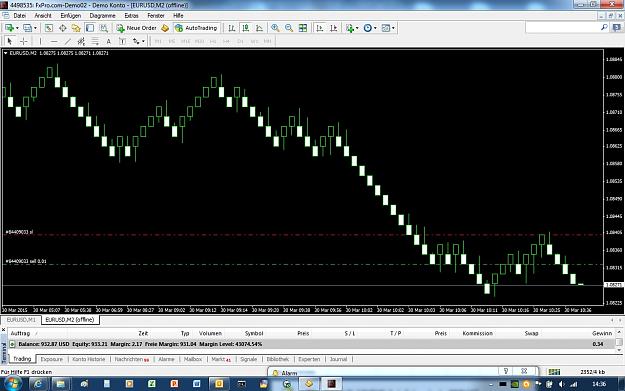

First, to answer your question, I use 5 and 10 pips Renko Brick size. I tested 2.5 Bricks as well with not too good results.

Second, my thoughts to this. Thus I use the same EA for generating the bricks and executing the trading logic, it should work to change the brick size on the fly without user interaction. I will try and provide feedback ( not by today ).

This strategy: Renkos are great, they filter out noise and provide a "mini trend" already when you enter the trade. Exits ( trade close ) are quite costly, they always set you back by 2 bricks, often almost by 3 when the price started to move against the trade just a tiny distance before the next brick would have been generated. IMO there is room for a better ( and more cheap ) exit strategy, but this is not part of the current strategy discussed here.

I think, one of the biggest advantages of Renko Bricks, to eliminate time, is also one of it's biggest downsides. Time helps to identify the strength of a move and it's a difference whether a 50 pips move happens in 5 hours or in 5 minutes. Member krumpy in this thread mentioned already the importance of the speed of a price move which is not in line with the concept again, but I fully argee with him and will consider the speed of price changes as well.

However, when you dig into Renkos and see that the take profit approach has some issues as well as the timeless concept has downsides, you could end up quite quickly with an EA that has not much in common with Renkos anymore. I ran into this issue yesterday by designing and coding alternate trade exit solutions which I removed from the code again to be compliant with the overall Renko concept discussed here.

When a trader is able to make profit for years by using a Simple Renko Strategy, an EA should be capable to do this as well. I know that humans and machines behave very different, the OP will have additional criterias when to enter a trade like the price distance to the EMAs, the length of the Renko legs, etc. He sees this in a blink of an eye while our current robots don't care about ATM. As one more examlpe, I see instantly when the price is stalling and would not enter a trade then. All this is not coded and so the EA continues trading. One more criteria might be SR lines, where I watched the EA running into them up to 4 times, resulting in 4 losses.

At all, have a great day !