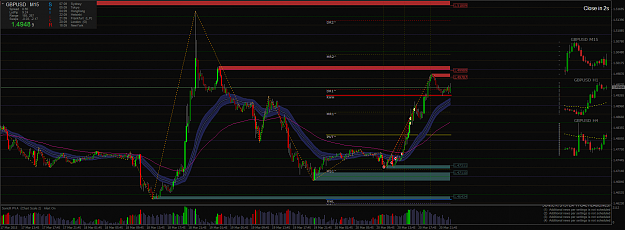

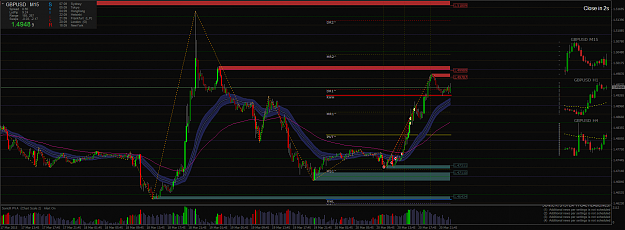

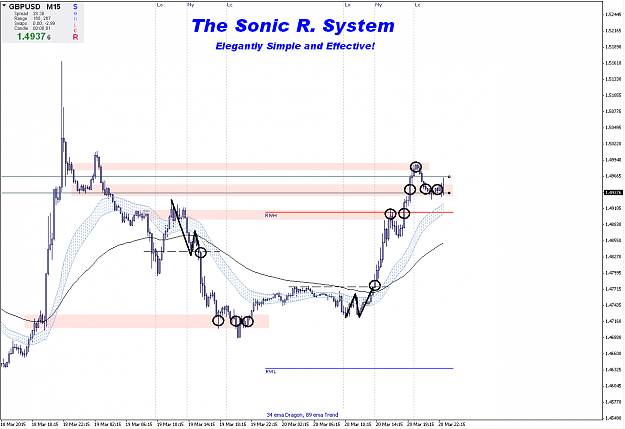

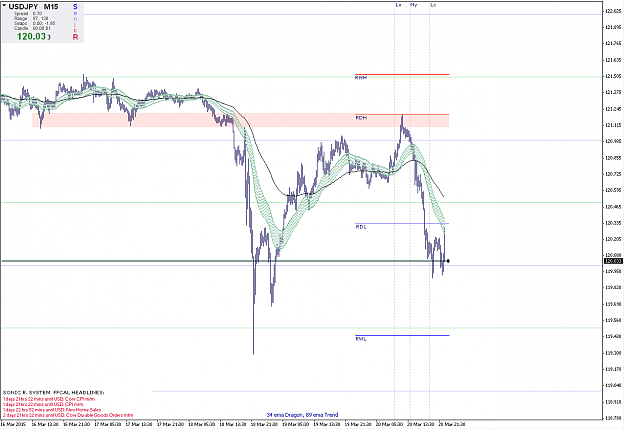

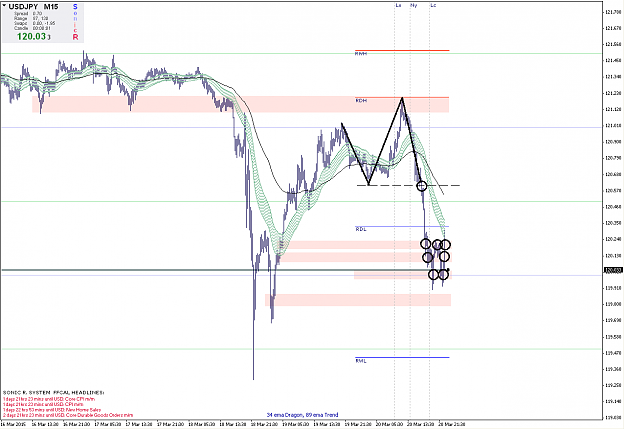

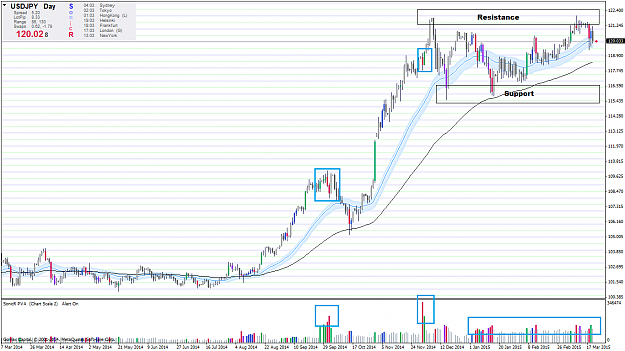

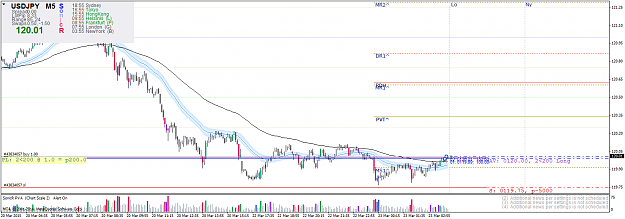

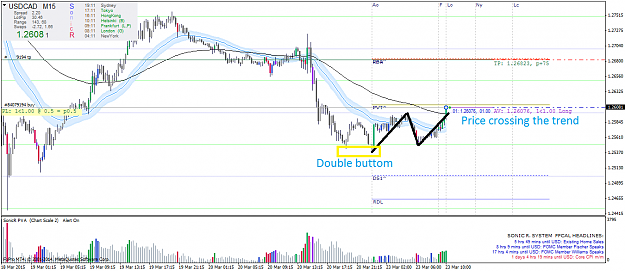

Disliked{quote} Trades closed with 58 + 22 + 38 pips profit - 118 pips total. Decided to close because I have to go away now and cant monitor the trades. I rather close with "small" profit than seeing red later. This is my first rule.{image} {image} {image} Regards FN

Ignored

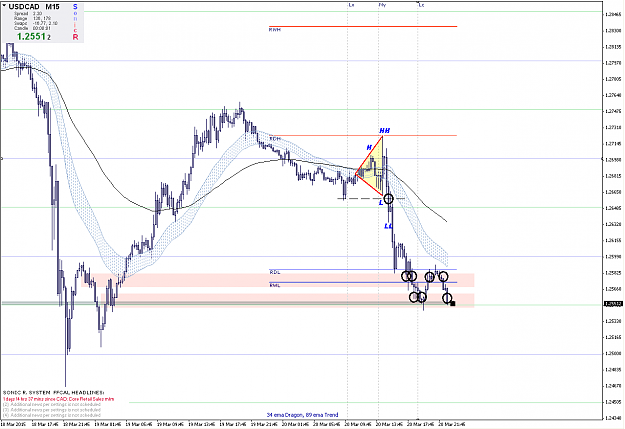

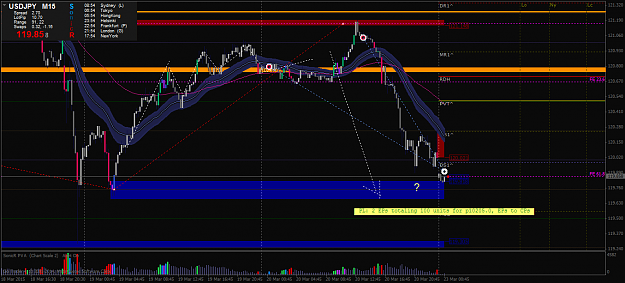

DislikedToday I wiped my profit from this week. Dont let your emotions and greed control you! This is a very hard lesson to learn. Happened not the first time, but I hope it was the last!Have a nice weekend Sonicers! Regards FN

Ignored

forexn00b,

First, I do feel for your loss. Second, do not let it be in vain; figure out what went wrong and what you can do about it in the future, if anything, because sometimes we can do nothing but exit our trade with a loss.

Thirdly, and important now to the thread, is that you failed to post the entries and exits of any subsequent trades you lost on. The post previous to your last post was about closing profitable trades. Nothing since then? How are the other members of the SonicR Team going to learn along with you from unprofitable trades you only refer to? They cannot see the circumstances of your trade entries nor exits. The function of this thread is to provide ongoing examples of the application of the Sonic R. System, regardless of how the trades complete. Win or lose, all are valuable illustrations from which we can all improve our learning here. You missed an opportunity to contribute to this thread. Understood?