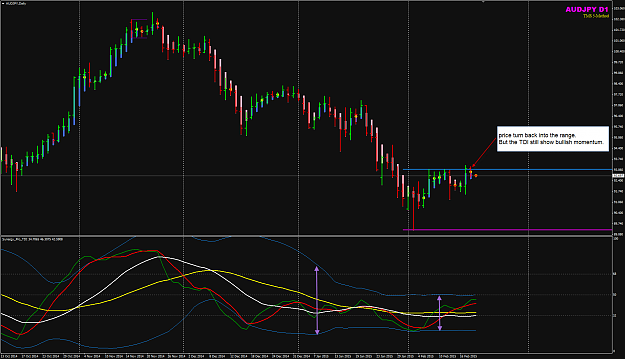

Disliked{quote} {image} Here is an update on Kiwi. Yesterday was a good D breakout of the previous D Inside Bar and also the Outside Bar. Potential TP region is Dec Low and the most recent price swing low close. Still possible to get an intraday H1 setup entry today. regards, {image}Ignored

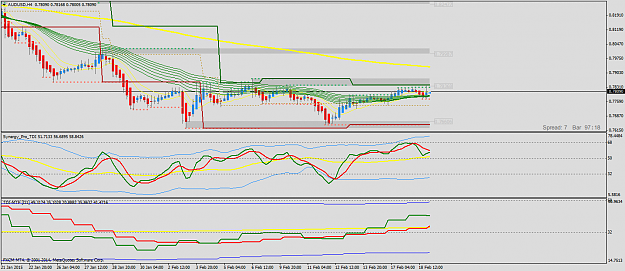

Here is a quick update on Kiwi:

We see a reaction / price pulled back near the 50EMA. But the APB still blue and long upper wick, the TDI still show momentum.

Trade management wise, I will look at how today' price bar and APB Day candle will close.

Good Trading to all you TMS folks.

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett