"China's overseas borrowings are leaving the country increasingly vulnerable to a rise in U.S. interest rates, potentially creating funding problems for some companies and tighter conditions for the financial system overall." source: Overseas loans expose China to US rate hikes - MarketWatch

In other news, HSBC today reported its final Composite and Services PMI figures for China for the month of July. Composite PMI came in at 51.6 vs. 52.4 in the prior month, snapping a three-month streak of improvements. The Services PMI printed at 50.0 vs. 53.1 for June, its lowest reading since the report was first published in August 2011.

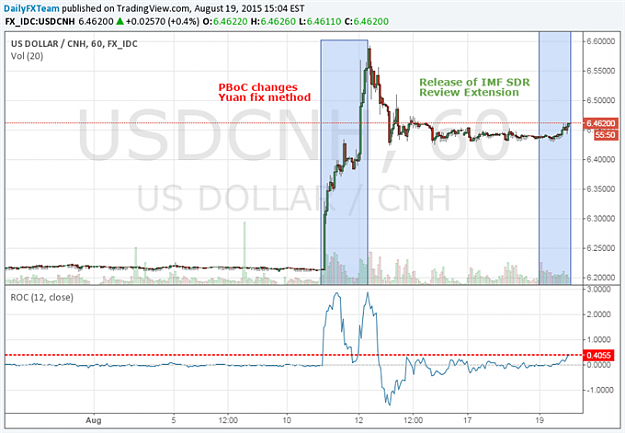

The Chinese Yuan fell against the US Dollar after the disappointing PMI numbers crossed the wires.

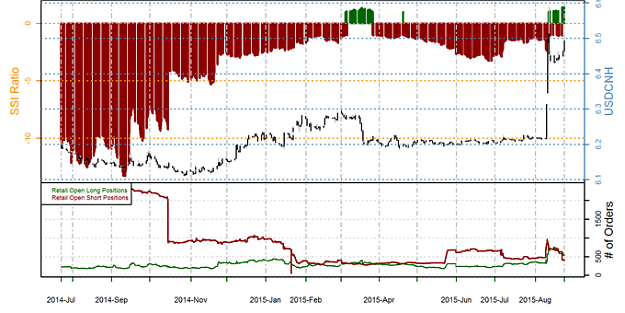

In addition, the Speculative Sentiment Index (SSI) shows that the ratio of long to short positions in USD/CNH stands at -11.77 meaning there are 11 retail traders who are short for each trader who is long. Yesterday the ratio was -11.16.

SSI is a contrarian indicator to price action, so the fact that the majority of traders are short gives signal that USD/CNH may continue higher. The trading crowd has grown further net-short from yesterday and last week. The combination of current sentiment and recent changes gives a further bullish trading bias.

In other news, HSBC today reported its final Composite and Services PMI figures for China for the month of July. Composite PMI came in at 51.6 vs. 52.4 in the prior month, snapping a three-month streak of improvements. The Services PMI printed at 50.0 vs. 53.1 for June, its lowest reading since the report was first published in August 2011.

https://media.dailyfx.com/illustrati..._Picture_1.png

The Chinese Yuan fell against the US Dollar after the disappointing PMI numbers crossed the wires.

In addition, the Speculative Sentiment Index (SSI) shows that the ratio of long to short positions in USD/CNH stands at -11.77 meaning there are 11 retail traders who are short for each trader who is long. Yesterday the ratio was -11.16.

https://media.dailyfx.com/illustrati...Picture_19.png

SSI is a contrarian indicator to price action, so the fact that the majority of traders are short gives signal that USD/CNH may continue higher. The trading crowd has grown further net-short from yesterday and last week. The combination of current sentiment and recent changes gives a further bullish trading bias.