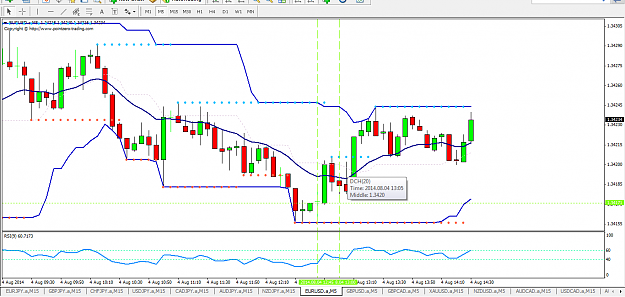

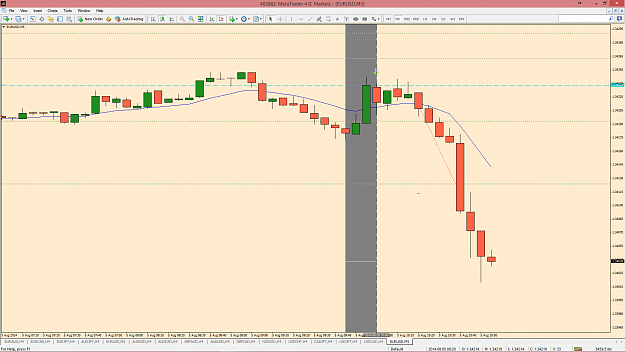

Tried today to trade the EURUSD, had good result but was away to close at the Donchanian Peak so I've left the trade open. Couldn't set my stop loss/trade point because of an EA in the background moving and placing my SL/TP so that's why I left it. Good result this morning from indications.

Also attached a 9 period RSI with levels set between 40/60 for indication as to when is good to buy and sell when looking for setting of trade point perhaps.

Also attached a 9 period RSI with levels set between 40/60 for indication as to when is good to buy and sell when looking for setting of trade point perhaps.