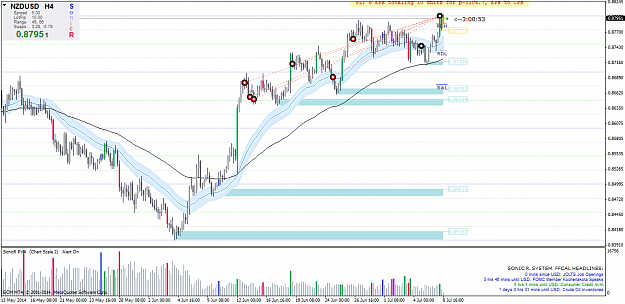

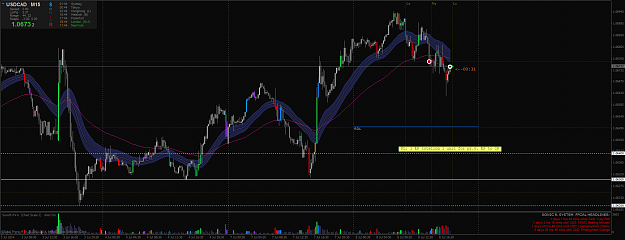

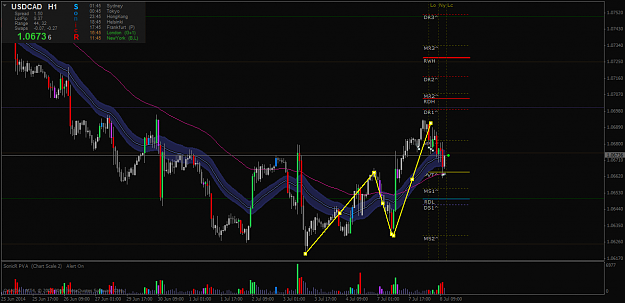

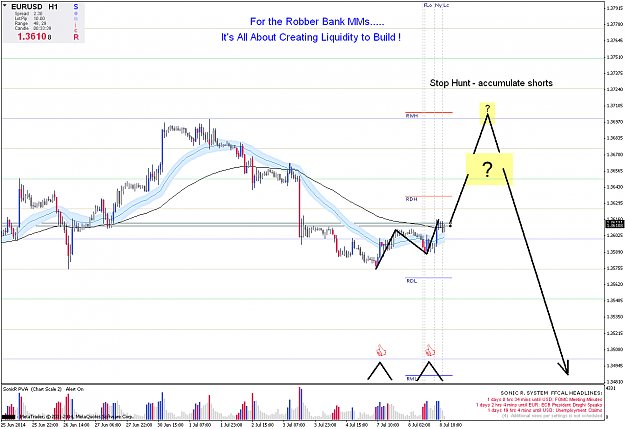

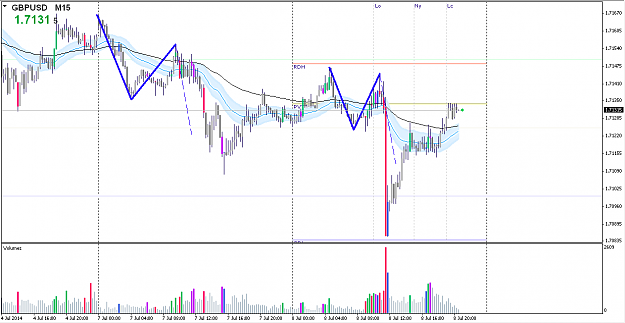

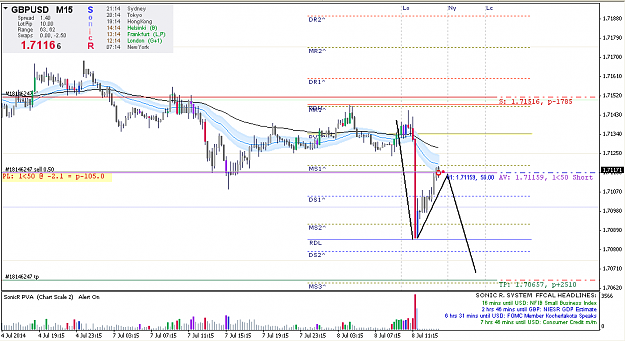

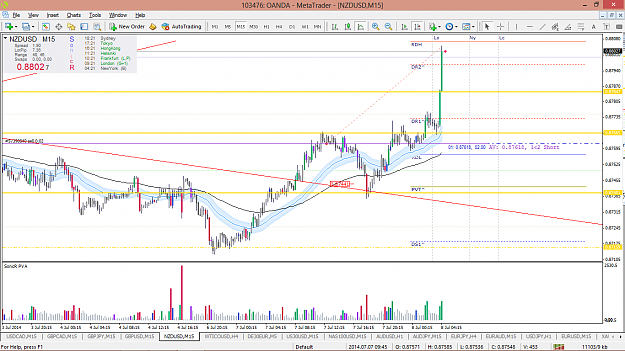

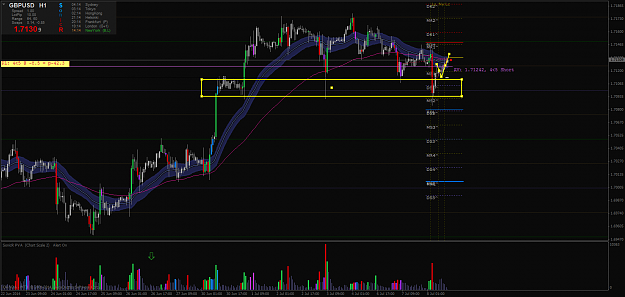

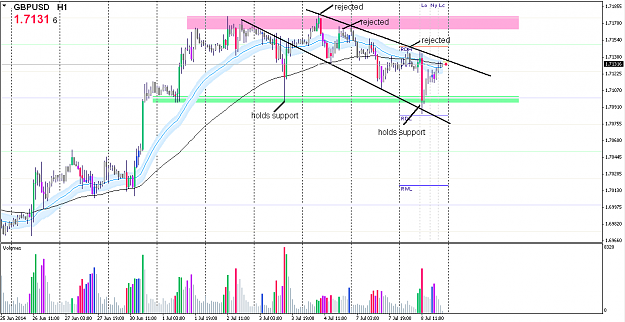

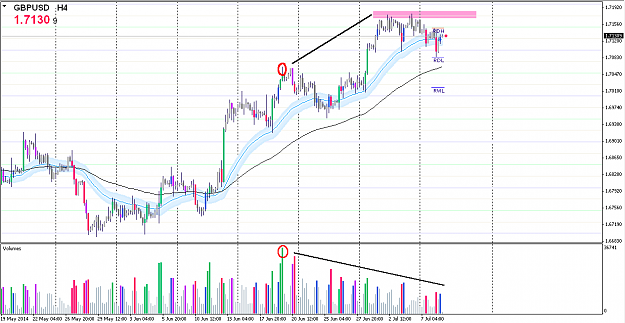

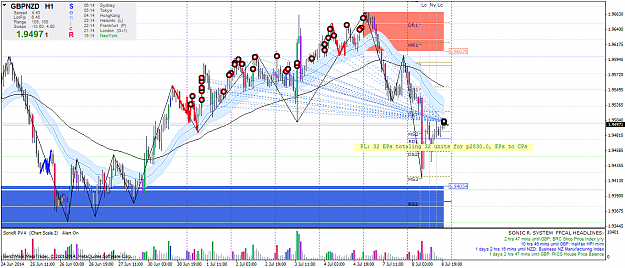

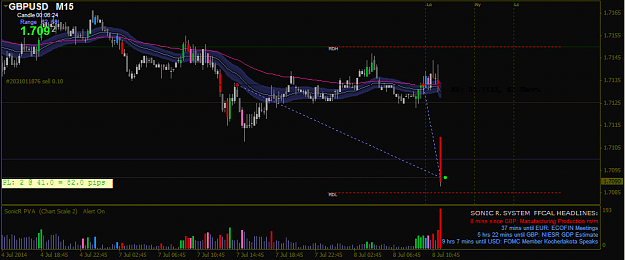

DislikedRecently Prof Tah had given some comments on some pairs (XAGUSD,GBPUSD,NZDUSD & USDCAD).It is such a coincidence that I am currently holding trades on these 4 pairs. Some of it was started from Classic while some of them were Scouts. Like Gupito, I still hold GBPUSD short trades. Like Sailyfee, I still hold NZDUSD short trades. Quite agree with Gupito's words " Do not afraid to lose" I think before we earn profit, we must have the courage to endure with the temporary loss, Hopefully my patience will get repay eventually. {image} {image} {image}...Ignored

Trading is not easy