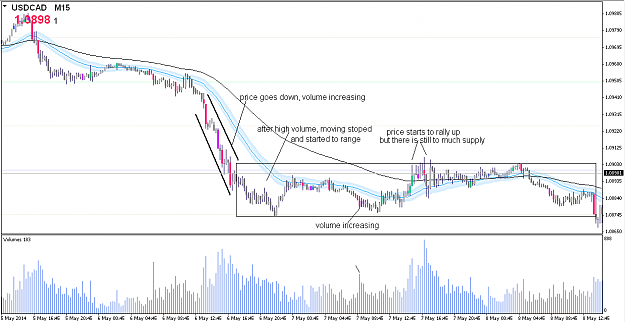

Disliked{quote} Sonicers, Those of you that will persist to add to a trade in the "red", if you do not understand Sonic's intentions and the reasons for his exhortations against doing so, then read this post by Guptio1508. Thank you, Gupito1508, for taking the time to reveal your personal challenge, as well as those details supporting Sonic's exhortations.Sonicers experienced with PVSRA know what a wonderful tool it is. Aside from those times in the market when nothing is real clear, PVSRA nails whether the robber banks are bulls or bears. Unfortunately...

Ignored

nice follow up explanation, this extremely informative for newbie