Alright. I will search something from there to fit in.

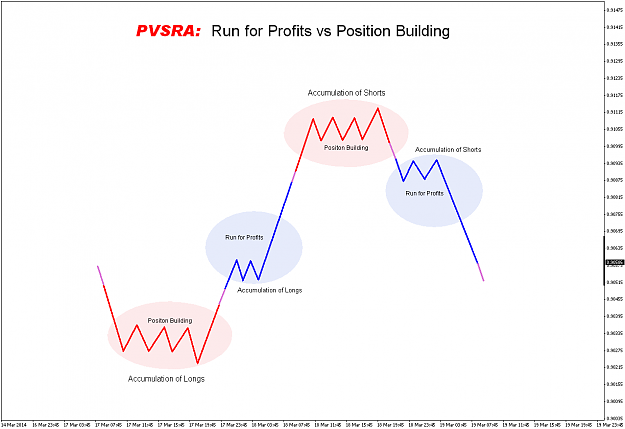

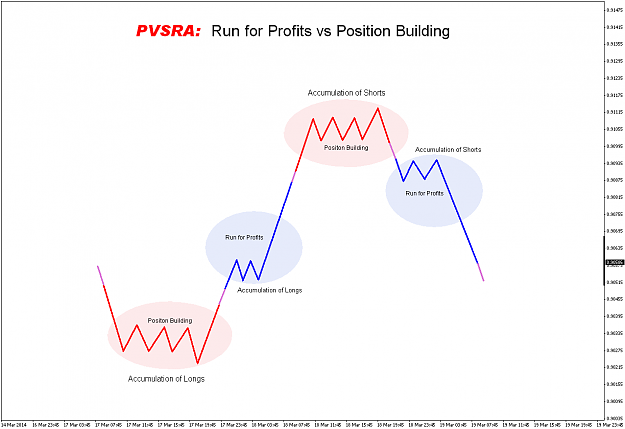

Nevertheless, thank you Traderathome for sharing pvsra. I'm going to experiment some more with it.

Nevertheless, thank you Traderathome for sharing pvsra. I'm going to experiment some more with it.