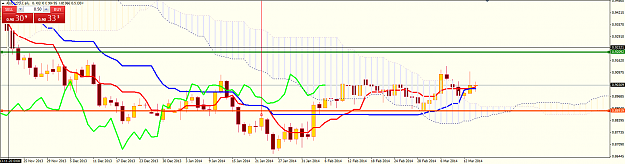

Contrary to preceding speaker I see some more room for fall.

Both scenarios assume drop either to 0.8850/00 area or 0.85/0.86 area. Both plays will be invalid if we break 0.9133 BEFORE reaching to at least 0.8850/00 area.

Possible triggers :

a) (unfortunately) escalation of Crimea conflict after tommorows referendum (risk-off and outflows from AUD which is percieved as speculative currency)

b) bad data from China somehow shade (the recent) better ones from Australia

c) those who enthusiastically jumped on inverted head and shoulders pattern might be vulnerable to long squeeze

We shall see how it unfolds in upcoming days

Both scenarios assume drop either to 0.8850/00 area or 0.85/0.86 area. Both plays will be invalid if we break 0.9133 BEFORE reaching to at least 0.8850/00 area.

Possible triggers :

a) (unfortunately) escalation of Crimea conflict after tommorows referendum (risk-off and outflows from AUD which is percieved as speculative currency)

b) bad data from China somehow shade (the recent) better ones from Australia

c) those who enthusiastically jumped on inverted head and shoulders pattern might be vulnerable to long squeeze

We shall see how it unfolds in upcoming days