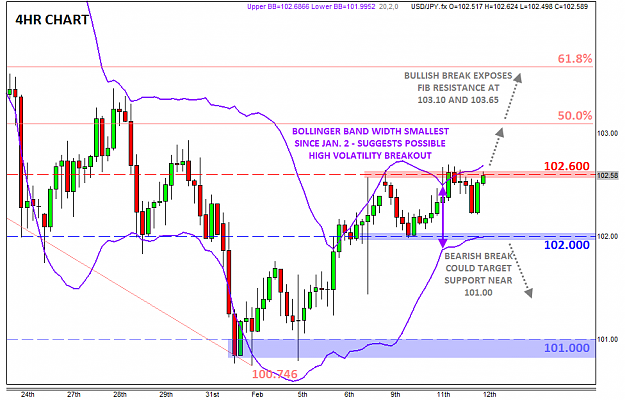

Tomorrow could possibly light the fireworks for 102.6 or 102.

- Post #43,001

- Quote

- Feb 12, 2014 1:02pm Feb 12, 2014 1:02pm

- | Joined Jan 2014 | Status: Member | 37 Posts

- Post #43,002

- Quote

- Feb 12, 2014 2:57pm Feb 12, 2014 2:57pm

- | Joined Jan 2014 | Status: Self Taught | 851 Posts

- Post #43,003

- Quote

- Feb 12, 2014 3:02pm Feb 12, 2014 3:02pm

- Joined Jun 2012 | Status: ケンジ | 21,416 Posts

- Post #43,004

- Quote

- Feb 12, 2014 3:16pm Feb 12, 2014 3:16pm

- Joined Jan 2014 | Status: Less is more ... | 8,990 Posts

Fix up, trade sharp ...

- Post #43,008

- Quote

- Feb 12, 2014 8:38pm Feb 12, 2014 8:38pm

- | Joined Jan 2014 | Status: Member | 37 Posts

- Post #43,009

- Quote

- Feb 12, 2014 8:51pm Feb 12, 2014 8:51pm

- | Joined Aug 2009 | Status: "Protect yo neck"- WuTang Financial | 854 Posts

- Post #43,010

- Quote

- Feb 12, 2014 8:55pm Feb 12, 2014 8:55pm

- | Joined Jan 2014 | Status: Member | 37 Posts

- Post #43,012

- Quote

- Feb 13, 2014 2:17am Feb 13, 2014 2:17am

- Joined Mar 2007 | Status: Member | 8,618 Posts

Gone to a better place

- Post #43,013

- Quote

- Feb 13, 2014 2:44am Feb 13, 2014 2:44am

- Joined Aug 2013 | Status: Member | 4,057 Posts

- Post #43,014

- Quote

- Feb 13, 2014 3:42am Feb 13, 2014 3:42am

- | Joined Sep 2013 | Status: Member | 206 Posts

- Post #43,015

- Quote

- Feb 13, 2014 4:47am Feb 13, 2014 4:47am

- | Joined Jan 2014 | Status: Member | 37 Posts