Back from Xmas-holiday-time my best wishes to all participants and readers of the thread. Have a happy New Year with healthiness and personal luck.

The latter is important as you can see i.e. that Michael Schuhmacher was certainly healthy but had no luck in his accident.

The latter is important as you can see i.e. that Michael Schuhmacher was certainly healthy but had no luck in his accident.

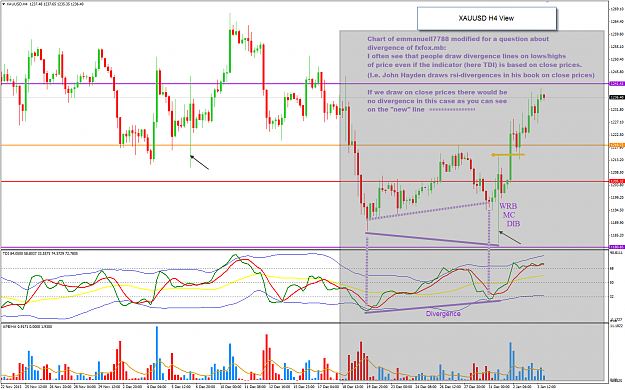

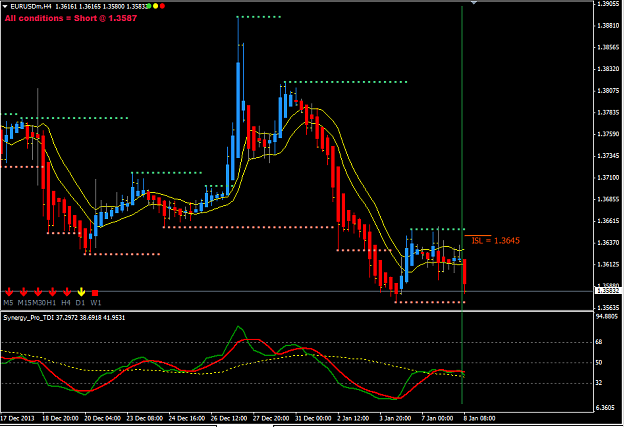

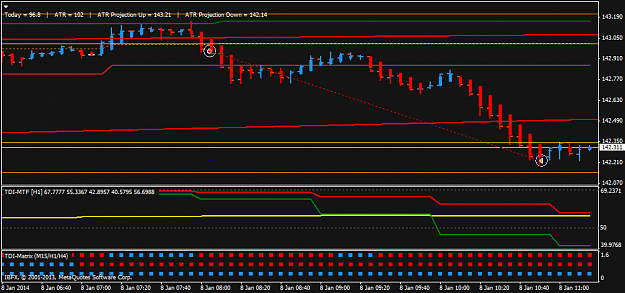

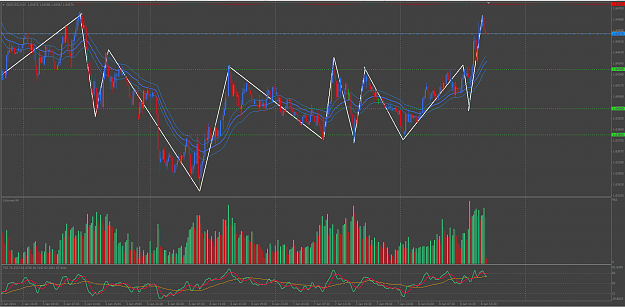

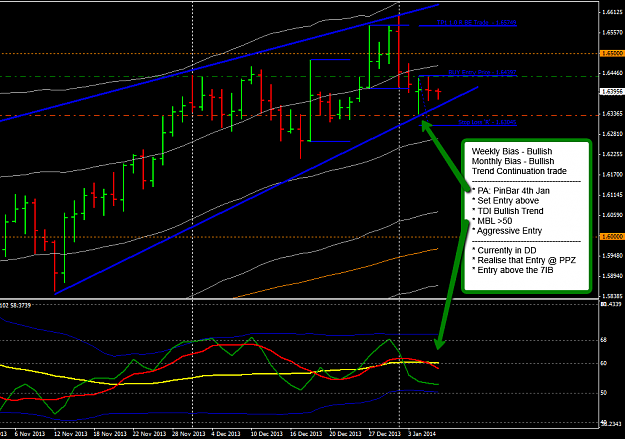

fxFox (all times in my charts are GMT+1)