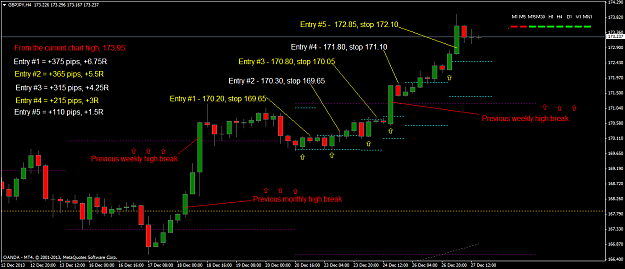

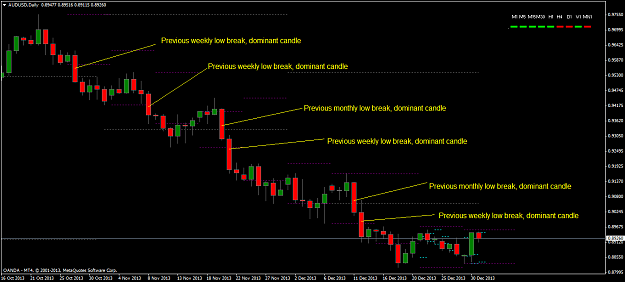

Here is a more detailed look at stacking. Entries and exits were rounded to the nearest 5 pips for example's sake. All signals closed up on their respective days, and all triggered on the next bar. There would be no reason to exit any of these positions yet.

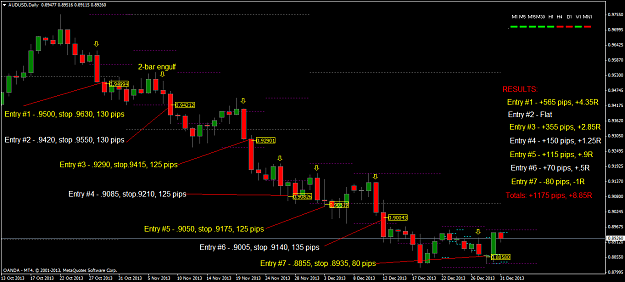

Although this move happened over the holiday period, these patterns repeat themselves over and over and over again. Of course, you're not going to get a stacking opportunity like this on every single engulfing bar that goes with the daily trend. Some will be stopped out. Some will be flatted. This is just an example of what it's supposed to look like when you're doing it right. Ultimately the market will decide the frequency and length of the signals. The best we can do is consistently be on the right side of the probabilities.

One very important thing to note. Take into context the 'playing field' in which these signals came into being. Price had recently broken its previous monthly high, and then consecutively broke previous weekly high two times in a row. Look at the candle that broke monthly high: solid. The candle that broke weekly high the first time: dominant. The candle that broke weekly high the second time: dominant. This market is screaming long at the moment. Context has a huge impact on how a single engulfing bar can be interpreted.

Although this move happened over the holiday period, these patterns repeat themselves over and over and over again. Of course, you're not going to get a stacking opportunity like this on every single engulfing bar that goes with the daily trend. Some will be stopped out. Some will be flatted. This is just an example of what it's supposed to look like when you're doing it right. Ultimately the market will decide the frequency and length of the signals. The best we can do is consistently be on the right side of the probabilities.

One very important thing to note. Take into context the 'playing field' in which these signals came into being. Price had recently broken its previous monthly high, and then consecutively broke previous weekly high two times in a row. Look at the candle that broke monthly high: solid. The candle that broke weekly high the first time: dominant. The candle that broke weekly high the second time: dominant. This market is screaming long at the moment. Context has a huge impact on how a single engulfing bar can be interpreted.

1