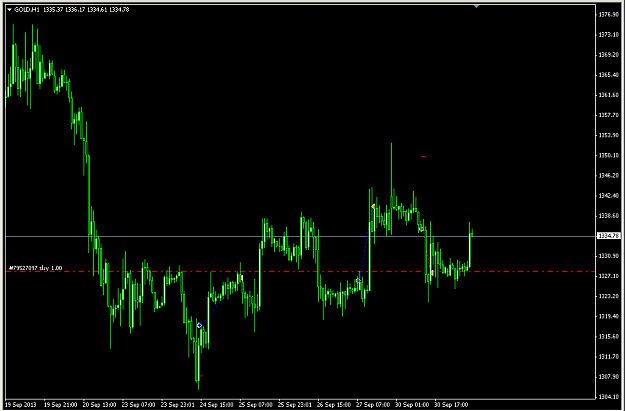

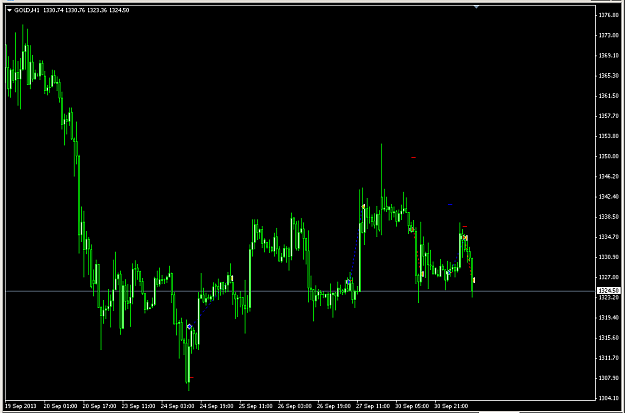

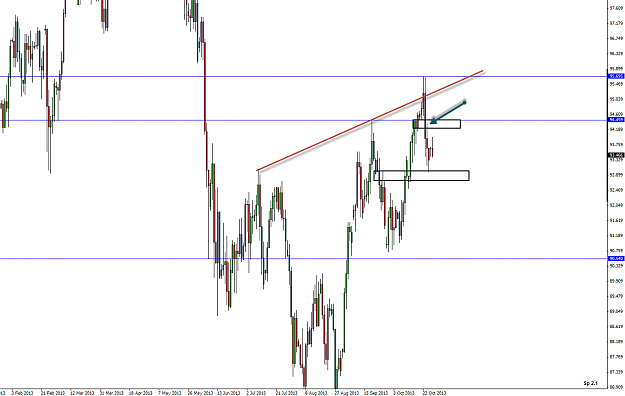

Hot potato on Gold, little over 5r.

- Post #5,582

- Quote

- Oct 1, 2013 3:13am Oct 1, 2013 3:13am

- | Joined Oct 2010 | Status: Member | 160 Posts

Price Is The Best Indicator Itself.

- Post #5,584

- Quote

- Oct 1, 2013 9:25am Oct 1, 2013 9:25am

- | Joined Oct 2010 | Status: Member | 160 Posts

Price Is The Best Indicator Itself.

- Post #5,585

- Quote

- Oct 3, 2013 5:52pm Oct 3, 2013 5:52pm

- | Joined Oct 2010 | Status: Member | 160 Posts

Price Is The Best Indicator Itself.

- Post #5,586

- Quote

- Oct 16, 2013 1:30pm Oct 16, 2013 1:30pm

- | Joined Oct 2011 | Status: Trader | 178 Posts

- Post #5,591

- Quote

- Oct 17, 2013 10:44am Oct 17, 2013 10:44am

- Joined Mar 2009 | Status: Member | 1,308 Posts

The purpose of knowledge is action, not knowledge

- Post #5,592

- Quote

- Oct 17, 2013 2:16pm Oct 17, 2013 2:16pm

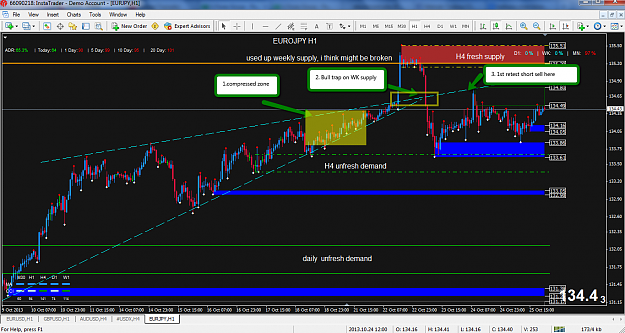

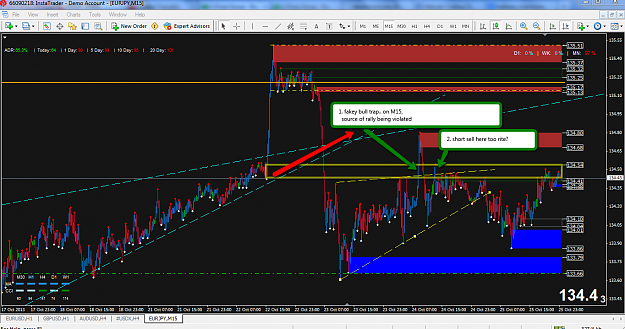

- | Joined Oct 2011 | Status: Trader | 178 Posts

- Post #5,594

- Quote

- Oct 17, 2013 2:54pm Oct 17, 2013 2:54pm

- | Joined Oct 2011 | Status: Trader | 178 Posts

- Post #5,595

- Quote

- Oct 18, 2013 2:47am Oct 18, 2013 2:47am

- | Commercial Member | Joined Feb 2008 | 4,633 Posts

- Post #5,596

- Quote

- Oct 18, 2013 6:41am Oct 18, 2013 6:41am

- | Joined Oct 2010 | Status: Member | 160 Posts

Price Is The Best Indicator Itself.

- Post #5,597

- Quote

- Oct 20, 2013 3:22am Oct 20, 2013 3:22am

- | Commercial Member | Joined Feb 2008 | 4,633 Posts

- Post #5,599

- Quote

- Oct 28, 2013 11:46am Oct 28, 2013 11:46am

- | Commercial Member | Joined Feb 2008 | 4,633 Posts