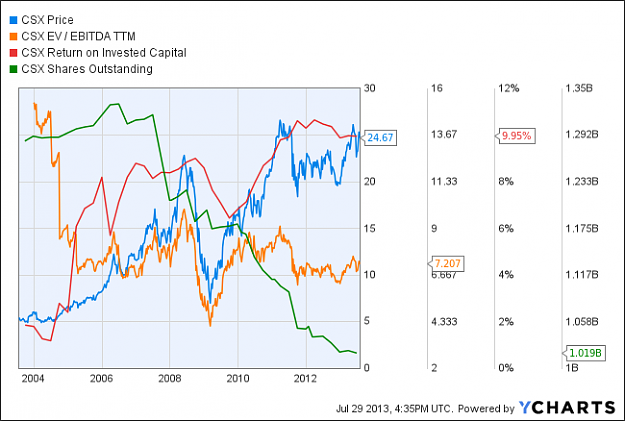

DislikedHi Split, I do apologize for my being lazy, I grazed through the last posts, but u know stocks like I know Gold, so what do we like this week? Perhaps I can use netdania as my demo for stock trading. Love your analysis and dedication. Please keep up the good work. XT- PS. Miners? How about CSX and COCA COLA not sure the ticker, + playboy for long term holds. I like railways.Ignored

Hi X nice to have you back! On gold miners, I personally don't think that the bear market is dead yet. It's just my opinion and I could be wrong about it, u would know better on it. I know for a fact that declining gold prices would squeeze gold miners margins and hurt their profitability especially given the fact that the main variable that drives stocks are "EARNINGS".

I have personally learnt from experience that I am paid from the market when I do my own work, picking stocks that on discretionary intuition hasn't always worked out best for me. Neither has stocks that were picked based on recommendation of XYZ hedge fund manager on CNBC or Bloomberg or any other source that was prepared by people who could be fa-liable. I have learnt from experience and from trial and error that a systematic approach to selecting market opportunities worked best. My investment process follows the following steps in order:

1. Scan for opportunities: Here I scan the +7000 stocks in the NYSE and NASDAQ for stocks depending on predicted direction of the overall market. For example, if I am bullish then I use a bullish scan on stocks with positive fundamentals, stocks that are mainly undervalued in one way or another. These stocks usually fall under 2 categories: a. value; b. growth.

I use Ycharts primarily to scan for these opportunities and I use finviz after scanning in Ycharts as a supplementary tool, finviz has features that can’t be found in Ycharts. I do this on a monthly basis. I generally have 4 scans in total to look for, 3 of them are bullish in nature and 1 is bearish. An example of a bullish scan would be to look for value stocks that demonstrate:

1. Low EV/EBITDA <10 times

2. High return on invested capital (ROIC) > 15%

3. A market cap > $200 million

This is essentially the magic formula, suggested by Greenblatt. This list from Ycharts usually comes back with 200-300 stocks, if I get a list that is larger than this then I usually increase the criteria and act more conservative, or I select more stocks in sectors that I like. These stocks are then imported on to the finviz scanner, where I run the charts function to look at their daily charts. If I recognize opportunity based on technical analysis, I write down that stock on paper. Stocks that could be ignored are stocks that look completely broken, simple technical’s work best here. I like stocks that are late in their consolidation phase or stocks that are have broker out of a solid base and are cleanly trending. I want to be long stocks that look like they are in either accumulation or in a boom. Once this is done, I usually have a list of stocks from 30 – 50.

2. Adding stocks to Watch list: In this case I would add the above stocks to my magic formula list, and I would review every stock individually. The scan was designed to provide me with undervalued stocks relative to their earnings. Stocks are not usually down for now reason; something must have sent them down. There is always a catalyst, it then becomes my job to identify that catalyst and here is where the real work begins. This step is where I analyze the stocks fundamentals over the past 5 years, major news announcements on the stock on sites like YAHOO. I also check what other investors think about the stock on Seeking Alpha, I usually find the story why it is down here. I also check how the industry and sector has performed over the past and whether these industries are performing positively or poorly. Nothing is left for chance. Microeconomic analysis is also conducted first hand at this level, I looks for anything that might give me an edge including the fact that the stocks is being held by institutional hedge funds. If they like it, that means it’s probably good. They do have the sharpest minds in the world on board their firms after all. Key to note here is that, not everything is as simple as it first seems, second level thinking is paramount. You have to think outside the box cause your buying a stocks that is being misperceived by many. You want to be early for that big move, that big move only occurs after people start recognizing your investment.

3. Once I develop a thesis on a stock that I like, I usually do nothing. I write the thesis and I wait for the right time to buy. This is where my traders skills come into play, knowing its an undervalued stock that is being misinterpreted isn’t enough. I set alerts for levels I want to enter through IB, and wait for price to move to a level where I feel that the R/R is deeply in my favor. If I lose, then I lose small but if I win then I win big. Timing is key to this stage. In my previous example on PSX, everything looks good on the stock, it was being sold because it was a spinoff from COP. Entering before the base developed could have been a painful experience but look at the stock after it broke out.

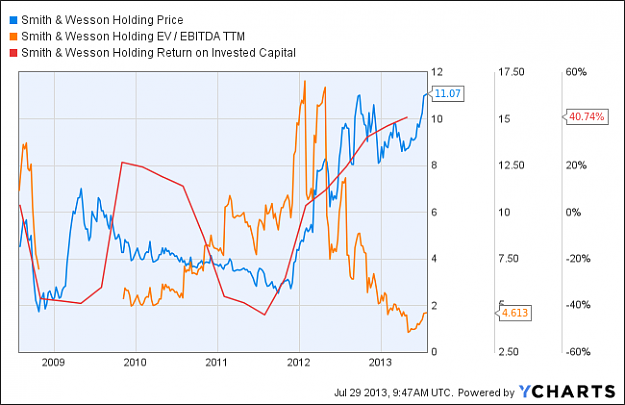

A recent example was HGG, a stock that was being slammed by the media day in and day out. They said the industry was dead, but despite all of that HGG kept on making money quarter after quarter while increasing stakeholder value. Short interest was extremely high, and technical’s formed a base so I bought the stock, and it then went up +120%. SWHC is the most recent example, the weapon maker was slammed really hard by congress and Obama after the high school shootings last year, the stock got crushed despite the fact that the proposed ban on selling weapons cause people to rush to the same company to stock up and buy more weapons which in returns made the stocks earnings ever better! Even after all of this the stock remained down, it has been recently been popping higher because people have short memories! Obama and congress only talked the talk but didn’t follow up by walking the walk. I found out about SWHC some 3-4 months after the proposed ban and there wasn't any follow up!

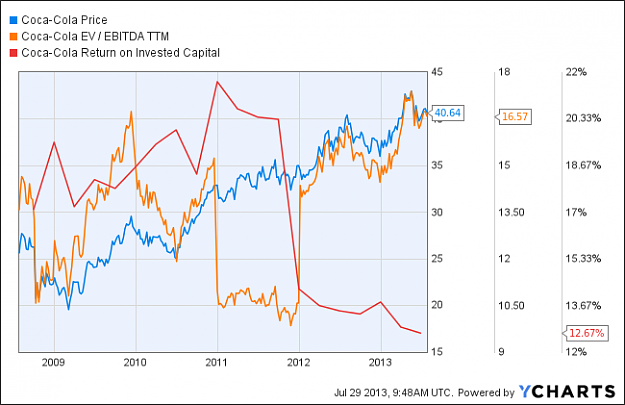

Now look at the magic formula at both Coca Cola KO and SWHC:

P.S. For anyone who doesn't understand financial ratios, a glossary is available at Ycharts.com

P.S.S. SWHC also saw a case of forced selling the by the California pension fund, situations of forced selling are no brainer value trades.