Disliked.... splitting of their trader base between PFL and Free-EXN as detrimental to their success.Ignored

DislikedSadly, most forex in US has fallen under the same decay due to ridiculous regulations....Ignored

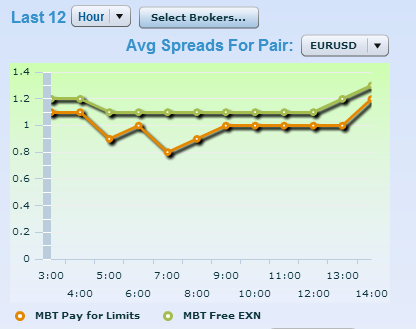

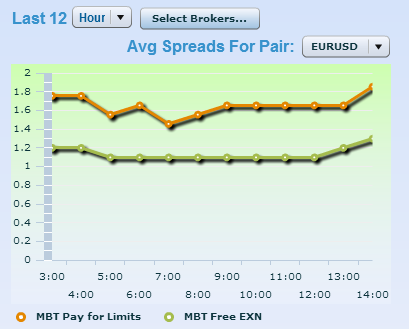

MB is a business. It's in its interest to charge as much as its traffic will bare. Oanda has raised its average spread (using EURUSD as a standard) and obfuscated the fact with "variable spreads".

I think MB upped their price as much as they thought possible when looking across the ever dwindling competitors left to serve the US customer base.

MB is still a good broker for small accounts, they are just not the value proposition they once were.