hey look eurcad is in fibo 38.2 level, so maybe waith for decision...U can switch on 4h and monitoring it but dont think that at close us session and asia we will have solution

I think U can trade with this trend fallow system on 4h timeframe with a lot of succes and U will fell this system

its only may opinion

thug

I think U can trade with this trend fallow system on 4h timeframe with a lot of succes and U will fell this system

its only may opinion

thug

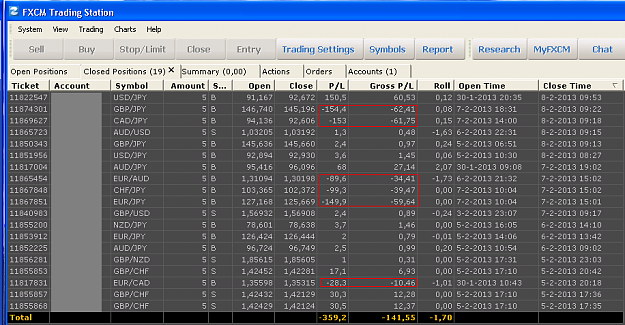

The market was bullish, turned bearish, and you'are brokish!!!