EDIT: Major revision to system starting at post #500

Well here we are on a brand new year. Hope all goes well with everyone in the coming trading year and beyond.

I have decided to start another thread to share a strategy that I have been trying recently with some success. I've learned much here at FF, so if someone else can benefit in some small way, then that would be great.

But first, the standard disclaimers:

This thread is not a signal service. I am not going to be giving my entries and exits on my trades. Do not trade this on a live account. If you do you will probably lose all of your money! You have been warned.

So now...on with As Easy as "PI"

PI is a simple trend following system using moving averages It is not complicated, it is not a radical new idea. Just my slant on some old standbys.

I trade PI on the daily charts only. I know many will ask if it will work on other time frames, so let me preempt that question.

The answer is I don't know. I haven't really tried it. I'm sticking with the daily because that's where I think you get the long term trends that are profitable with this system. It also fits in nicely with my trading schedule.

The history:

As I'm sure is the case with many of you, I have tried many systems and indicators to try and catch good entries and exits on major trends. That's where I think the money is, or at least a good share of it.

I messed around with a lot of indicators that seemed to do a better or worse job of showing up the trends.

Finally I've ended up with a simple MACD crossover using the values in "PI", thus the name. As you may know, PI is expressed fractionally as 22/7. So.....I am using the MACD with 22 as the slow MA and 7 as the fast. (I'll let you more esoteric types ponder the cosmic significance of that )

)

I enter when the MACD crosses the zero line and close/reverse when it crosses the other way.

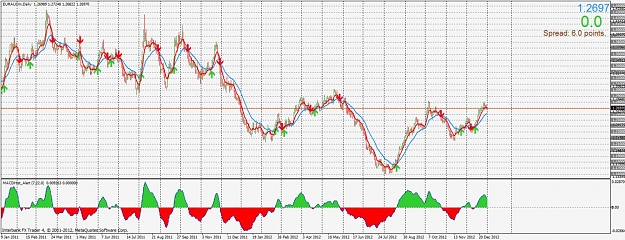

Take a look at the daily EurAud chart below for the last couple of years.

Some pretty great trends can be captured this way.

So the purpose of this thread is to discuss the strategy. I'll try to answer any questions. I'm not looking for wholesale changes to be implemented, certainly not adding multiple indicators to filter trades. For every bad trade you filter out, you'll probably filter out a good one.

That being said, there are always improvements that can be implemented and you all may have some valuable insights.

More on trade setups, stacking of trades and money management to come.

Well here we are on a brand new year. Hope all goes well with everyone in the coming trading year and beyond.

I have decided to start another thread to share a strategy that I have been trying recently with some success. I've learned much here at FF, so if someone else can benefit in some small way, then that would be great.

But first, the standard disclaimers:

This thread is not a signal service. I am not going to be giving my entries and exits on my trades. Do not trade this on a live account. If you do you will probably lose all of your money! You have been warned.

So now...on with As Easy as "PI"

PI is a simple trend following system using moving averages It is not complicated, it is not a radical new idea. Just my slant on some old standbys.

I trade PI on the daily charts only. I know many will ask if it will work on other time frames, so let me preempt that question.

The answer is I don't know. I haven't really tried it. I'm sticking with the daily because that's where I think you get the long term trends that are profitable with this system. It also fits in nicely with my trading schedule.

The history:

As I'm sure is the case with many of you, I have tried many systems and indicators to try and catch good entries and exits on major trends. That's where I think the money is, or at least a good share of it.

I messed around with a lot of indicators that seemed to do a better or worse job of showing up the trends.

Finally I've ended up with a simple MACD crossover using the values in "PI", thus the name. As you may know, PI is expressed fractionally as 22/7. So.....I am using the MACD with 22 as the slow MA and 7 as the fast. (I'll let you more esoteric types ponder the cosmic significance of that

I enter when the MACD crosses the zero line and close/reverse when it crosses the other way.

Take a look at the daily EurAud chart below for the last couple of years.

Some pretty great trends can be captured this way.

So the purpose of this thread is to discuss the strategy. I'll try to answer any questions. I'm not looking for wholesale changes to be implemented, certainly not adding multiple indicators to filter trades. For every bad trade you filter out, you'll probably filter out a good one.

That being said, there are always improvements that can be implemented and you all may have some valuable insights.

More on trade setups, stacking of trades and money management to come.