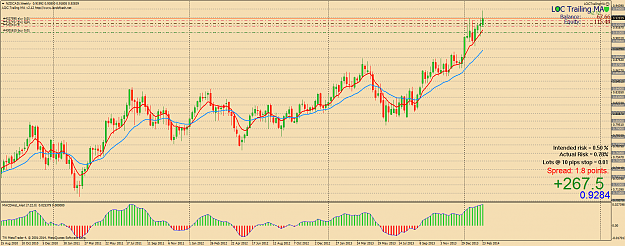

So if any of you have looked through the thread you will have noticed that we had a good measure of success in the early part of 2013. We had increases of 10's of thousands of pips and I increased the account size by a factor of 10 (in floating profit at least). Much of this was due to the yen sell off over that time period. After all, that's what trend trading is all about.

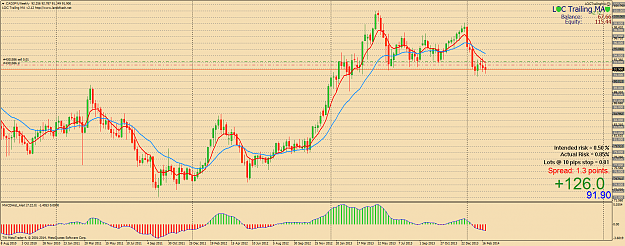

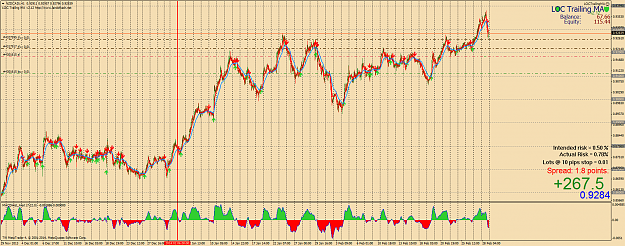

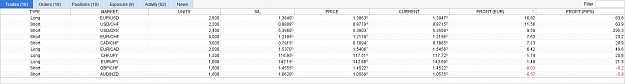

One problem came as I stacked trades (I love stacking trades). I was adjusting the lot size of each subsequent stacked trade in line with the new floating equity. What that in effect did was drastically increase the lot sizing of positions as they were further along in the trend. However, as is typical with trend trading strategies, the positions toward the end of the trend are sacrificed at a loss as the Price Action turns and the direction of your trend changes. So these large position sizes, although relatively small in pip count, were eating up the profits from the earlier huge pip count positions that were of much smaller lot size.

So...to remedy that error I am now basing the lot sizing on account balance and not equity. That way each position is exactly the same in terms of risk to the account balance.

Additionally, I am lowering the risk % on each trade. In the past, I had a lot sizing of 3%. I want to now lower that to eventually be around .5 - 1%.

I say eventually because...in order to get the spreads I want across as many pairs as possible I went to a ECN account which carries standard lot sizing. So 1 lot is 100,000 units. Smallest size I can trade is .01 lots or 1000 units. With the stop sizes typical with this strategy that equates to a higher risk based on my account size.

More like 3-5%. I'm willing to take this risk now due to the smaller size of my account, knowing that I may blow it up. However, as my account size increases I will lower my risk % down to where I want it.

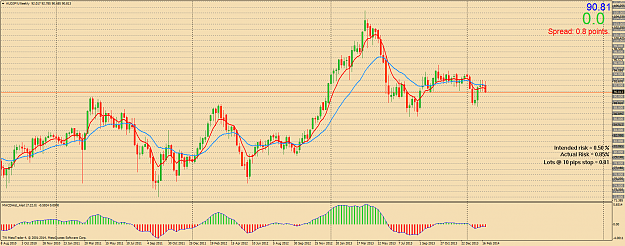

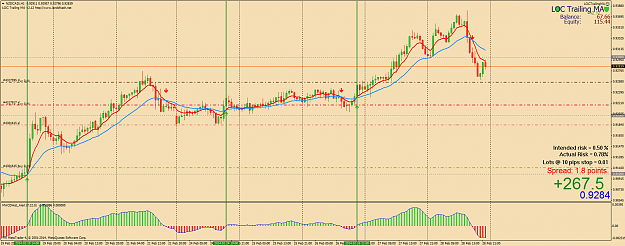

The other main issue creating drawdown on the account were the many losing trades experienced while waiting to hit a trending pair. As discussed earlier, this to some extent just goes with the nature of trend trading. But if we could reduce these negative hits it would obviously be better for our equity growth, and less painful to our psyche. So to help accomplish that I have introduced some additional Higher Time Frame (HTF) filtering into the system. This will hopefully keep us out of some choppy markets while still allowing us to get into the longer term trends.

...more to come...

One problem came as I stacked trades (I love stacking trades). I was adjusting the lot size of each subsequent stacked trade in line with the new floating equity. What that in effect did was drastically increase the lot sizing of positions as they were further along in the trend. However, as is typical with trend trading strategies, the positions toward the end of the trend are sacrificed at a loss as the Price Action turns and the direction of your trend changes. So these large position sizes, although relatively small in pip count, were eating up the profits from the earlier huge pip count positions that were of much smaller lot size.

So...to remedy that error I am now basing the lot sizing on account balance and not equity. That way each position is exactly the same in terms of risk to the account balance.

Additionally, I am lowering the risk % on each trade. In the past, I had a lot sizing of 3%. I want to now lower that to eventually be around .5 - 1%.

I say eventually because...in order to get the spreads I want across as many pairs as possible I went to a ECN account which carries standard lot sizing. So 1 lot is 100,000 units. Smallest size I can trade is .01 lots or 1000 units. With the stop sizes typical with this strategy that equates to a higher risk based on my account size.

More like 3-5%. I'm willing to take this risk now due to the smaller size of my account, knowing that I may blow it up. However, as my account size increases I will lower my risk % down to where I want it.

The other main issue creating drawdown on the account were the many losing trades experienced while waiting to hit a trending pair. As discussed earlier, this to some extent just goes with the nature of trend trading. But if we could reduce these negative hits it would obviously be better for our equity growth, and less painful to our psyche. So to help accomplish that I have introduced some additional Higher Time Frame (HTF) filtering into the system. This will hopefully keep us out of some choppy markets while still allowing us to get into the longer term trends.

...more to come...