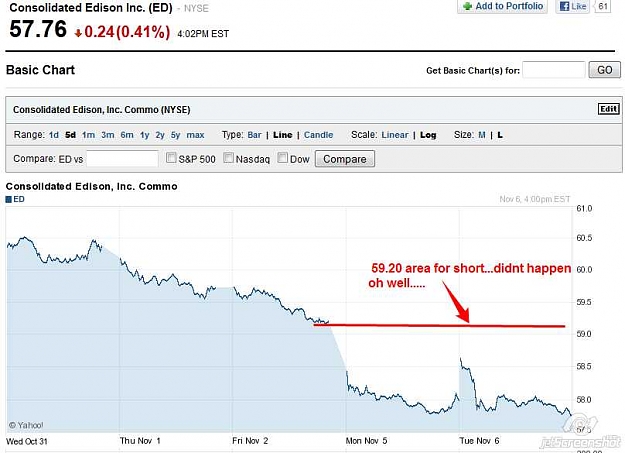

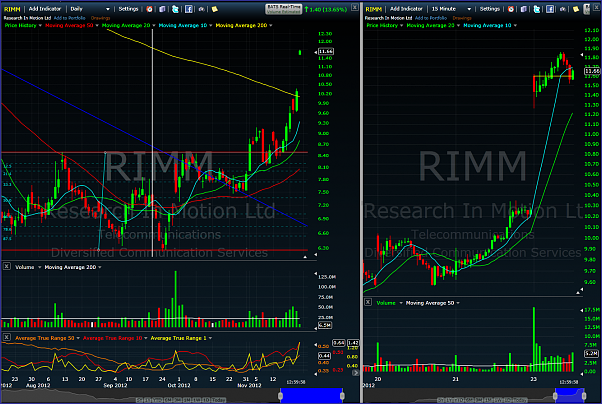

Dislikedwell...update...still 3hours into the market open....ED is getting hammered...broke below $59 and now testing $58.00....roughly dropped 4% in 3 days....anyways, we will see how hard it falls more....if it retraces to touch $59.20 area, i will short it.

chart update attached:Ignored

P.S. I am not in this, just my 2 cents