DislikedThank you again for comments

I stopped to follow EWI when they were expecting huge drop in Corn futures with their Wave 3 and after Corn made historical rally.. Lost enough with their helpI am sure they added some more patterns and update guidelines after i left.

By the way;

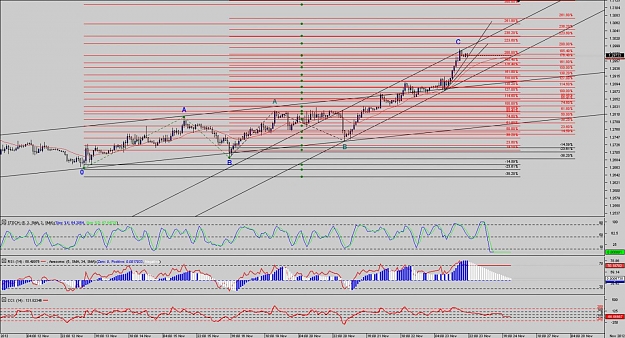

If 1.3172 is Wave A then Wave B is 33.3% of Wave A

If current low 1.3014 is the end of down move and it is Wave b of Wave 3 then it is 50% of Wave aIgnored

Correct on Wave B

Apologies I forgot the Wave (i) to 1.3071, pullback in Wave (ii) to 1.2825 and then take the comments above for Wave -i-, -ii- and Wave -a-... thus we are in Wave -b- of Wave -iii- of Wave (a). At least, that's the plan...

No I haven't got the wave structure wrong! I've corrected it!