DislikedGreat to see you trying it out! I think if you look at the first move higher ending just below where you have Wave A and call that lower high Wave (i) and then after an expanded flat the Wave (ii) you may find the projections easier to work out... My basic view is bullish in the larger wave degree and thus within the weekly outlook you have to decide what the outlook is and understand how to fit in a 5-wave move, what it will take etc.

I'd thoroughly recommend instead of those lines on the chart that you download the HEW spreadsheet from my...Ignored

Hi Ian,

thank you very much for your response. I had much fun reading your book. Was worth the money :-)

Right now I have to pay attention that I do not confuse the techniques. Constantly I try to count extensions LOL

Ian, I have a hard time to understand the following:

The waves are fractal. When I have an 1-2-3-4-5 impulse in traditional EW, than the fractal nature is easy to understand. 1-3-5 do consist out of 1-2-3-4-5 again. And so on.

But what about Harmonic EW? OK, we have an 1-2-3-4-5 impulse, too. But each of the actionary waves 1-3-5 consists of an A-B-C move.

When we start to think this further, we would get a strange fractal behavior, kind of alternating fractal. What do I mean:

let us look at the first impulse 1-2-3-4-5 (why is here a 5 wave and not an ABC)

now zoom into wave 1: we get A-B-C (where is the 5 wave structure) (only in substructures)

now zoom into wave A: we get A-B-C (where is the 5 wave structure) (only in substructure)

But that contradicts.

Maybe I am too confused right now with fractal behavior. But it all boils down to the question: at what wave degree there can be a 5 wave impulse and where not?

When we assume the system to be fractal, then each actionary wave should also be 5 wave (or we build a fractal system with only 3-wave moves). In no logical way we can assume a 5 wave move but the fractals of it to be only 3 wave moves.

The core question:

with what logic and on what timeframe we are looking for 5 wave moves?

With HEW we are forced to look at a specific time for a 5- wave move, don't we?

Well, we certainly may deny the fractal behavior of waves, but then we must be able to define the TF where the structure is 5 wave and where ABC

But when I read the intro of your web page correctly you too belief in the fractal nature.

Maybe it is hard to understand what I mean. I hope you do :-)

Second question:

You wrote, that the traditional Elliott waves seldomly reach the ideal fib-relations/targets. That is true from my experience too.

But when I look now at your extensions, there are only few fib numbers involved, too. Would it not be possible to gain similar results with "modified" fib-levels in traditional Elliott wave, too?

Lately I have dug deep into wave relationships. I found the work of Swannel quiet enlightening (see attached).

When I see your work and your levels, the levels I have found myself, the traditional levels, the work of Swannel, one comes to the conclusion, that it all boils down to the assumption, that it is not possible to forcast the exact end of a move. There are simply too many levels involved which are high probability retracement levels(zones).

But which of all this levels to chose, day in day out, with a high grade of reproducibility and confidence, that is beyond of my imagination.

When I remember correctly, fibs did not play a big rule in the beginning of Elliott works. It was baked in later.

When I started with Elliot wave years ago, I thought it was a tradeable system in itself. But in leveraged trading that simply does not work. I can say: I failed miserably. When I got early into an impulsive move I felt like the king of traders, but often enough my gains melted away in corrections or complex corrections.

I was only able to make a profitable system in combining EW with other methods.

Well, we can clearly see 5-wave moves in the market. But when we assume in HEW, that all the moves are fractal, and we are speaking generally of ABC corrective moves, then shouldn't we be on the way to claim,

that HEW works with only 3-wave moves? In this case we would have to label a toping wave 5 as kind of B-wave of an ABC-flat.

Doing it in this way would lead again to a fractal nature of HEW, which out of my sight the actual HEW not is (due to the discrepancy in 5-waves moves and 3 wave moves).

At least I have to think about that a bit longer :-)

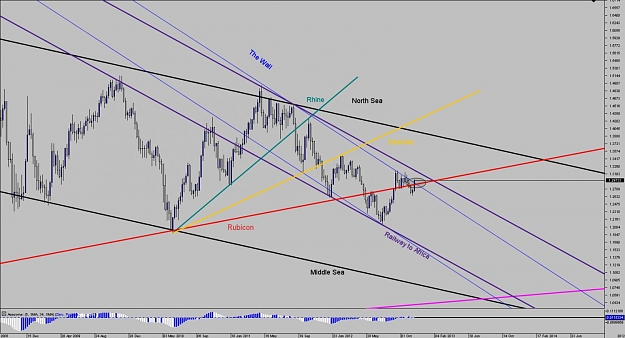

Here, last but not least, my modified count. Since I am not bullish (yet), my main count is that of an ABC-flat (blue) to the upper side.

Price has reached a nice clusterfield of wave C expansions. Out of my feeling now price should stop here or at max 3010-3020 former b), because when it goes higher we have a higher probability, that this is not wave C of the blue ABC-flat, but the whole move may develop into an impulsive move where we are now in wave 3.

OK, let us think bullish: we are in my alternate count of blue 1-2-3-4-5 up. Now at/near the end of wave 3 blue.

When we assume a max target for this recent wave up of 3021, then I got ideal retracement for wave 4 between 1.2958 and 1.2925.

Wave blue 2 is a flat correction, which C wave retraced less than 50%, but its A wave retraced more than 70%. Well, that leaves us guessing regarding alternation LOL

Wave 2 was complex, so we may see here only a zigzag, or in light of the pending Greece decision a sideways pattern like a triangle.

My Murey Math gives 2955 to 2940 ideally for this scenario. But risk is towards 2909 right now (or with Ian#s table 2912)

Trading conclusion:

best place to short was around 2985-2990 with risk at 3021.

Chance is ideally 2955 to 2940. When you short right here, R:R is bad, because of around 50pips risk and 25-50 pips return.

Conclusion:

short with SL right above the recent top, with TP 2960, 2945 and rest at will (with SL at BE)

if stopped out, watch 3020 to eventually reshort again with SL behind 3070.

Set money management accordingly.

Jan, many thanks for your Excel table. I found it a few days ago. Great tool :-)

Jan, one last question:

the retracement and expansion levels you use: have you obtained them via your observations, or are the obtained via statistical program? All I know right now is: they work very well

Catch you later, Markus